Cryptocurrencies are becoming more widely used for international transactions, including travel. The potential of a rapid, safe, low-cost, and genuinely worldwide payment system is enticing organizations and individuals worldwide to investigate the Bitcoin transactions regime. Bitcoin is currently the most extensively used cryptocurrency, while it competes with Litecoin, Ethereum, and Ripple in the global payments environment.

Continue reading to know about the pros and cons of using virtual currencies while traveling.

Contents

Pro: Converting Currency Gets Easy

Source: investopedia.com

You can quickly convert your money into local currency. When you’re traveling, finding a money exchanger, comparing rates, and so on isn’t always easy. Some people, in fact, find it difficult to convert and carry around local cash. Bitcoin can assist you if you’re one of these people.

BTC is digital money, which means you may use a Bitcoin wallet on your smartphone or laptop to carry it about with you. Hundreds of ways to exchange Bitcoin for cash or any local currency are available on cryptocurrency exchanges online.

You can also utilize a Bitcoin ATM, which works similarly to a standard fiat ATM. It’s available in 71 countries and supports a variety of cryptocurrencies, including Bitcoin Cash (BCH), Ether (ETH), Dash (DASH), and Litecoin (LTC).

These choices can help you avoid dealing with multiple currency conversions and bringing a large amount of cash with you when you travel.

To start trading in cryptocurrency and use it for traveling, visit thecryptogenius.software.

Pro: Make Payments That Are Anonymous, Simple, And Less Expensive

Source: csoonline.com

One of the many advantages of adopting this one-of-a-kind currency is its features. Bitcoin is a decentralized currency, which means it is not governed or controlled by any government or higher authority. As a result, it can almost smoothly perform cross-border transactions with little to no additional expenses.

BTC transactions are also quick and straightforward because you can send, receive, save, and monitor your funds all from your smartphone. There’s no need to be concerned about carrying significant sums of money any longer!

Pro: Easy Accessibility

Source: group.accor.com

Because cryptocurrency is available 24 hours a day, you can spend or buy it wherever you are, seven days a week. You don’t even need a computer to use it. Everything may be managed through your mobile device, which is now used by millions of people worldwide. As a result, you can quickly and rapidly check your accounts and make decisions in real-time. This ease of use has proven to be a crucial characteristic of bitcoin adoption, providing people across the globe with options they would not have had previously.

Pro: No Exchange Fee

Source: cryptowisser.com

Cryptocurrency pays in the local currency of the country where you buy it, and the transaction is completed in a matter of minutes. So, if you’re traveling abroad, you won’t have to worry about paying your credit card’s foreign transaction fees, calculating the currency rate when converting dollars to Euros, or trying to spend all those Euros you obtain at the ATM before you return home.

Pro: No Stress Of Getting Robbed

Source: medvisit.io

Pickpocketers, the bane of all travelers, won’t be able to take your Bitcoin from your backpack or while waiting in line at the ATM. Many individuals believe that cryptocurrency is safe (account numbers are unlikely to be hacked, unlike typical credit card numbers).

You’re probably safe if your crypto is saved in an account that you can access on your phone with a secure password. However, if you utilize a USB wallet that is stolen, you may be out of luck. Depending on the crypto exchange you use, you may not be able to fight breaches if they occur.

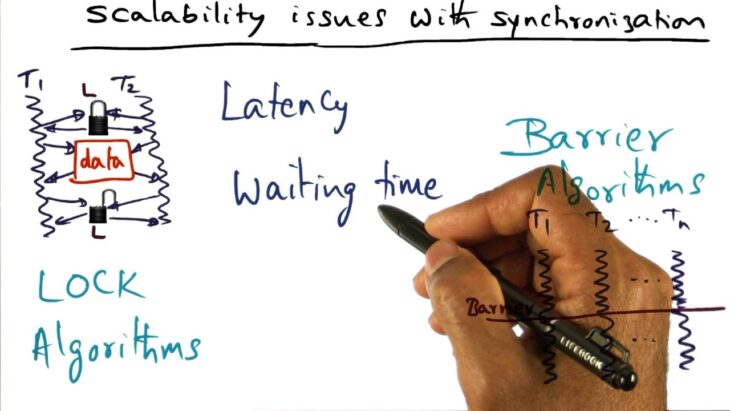

Con: Scalability Issues

Source: youtube.com

The challenges related to scalability are perhaps the most severe concerns with cryptocurrencies. The quantity of digital currency and its use is continuously expanding. However, cryptocurrency transactions are still dwarfed by the daily transactions conducted by payment companies.

Cryptocurrencies cannot compete on the same level as the big payment processing providers until their technology infrastructure is dramatically scaled to enhance transaction speeds greatly. It is challenging and complex to evolve cryptocurrency technology smoothly. However, various techniques have been proposed to solve scalability, including sharding, lightning networks, and staking.

Con: Cybersecurity Issues

Source: datacenterknowledge.com

Because cryptocurrencies are digital technology, they will always be vulnerable to cybersecurity breaches by hackers. It has already happened, with bitcoin investors losing hundreds of millions of dollars due to security breaches. The only approach to address and minimize this problem is to maintain the security infrastructure up to date.

Many prominent bitcoin players are now directly dealing with this issue. They accomplish it by deploying advanced cybersecurity safeguards that go above and beyond the features used by traditional banking companies.

Con: Super Volatile Market

Source: economictimes.indiatimes.com

The price volatility of cryptocurrencies, which is linked to their lack of intrinsic value, is a severe issue. One of the main reasons some analysts have labeled the bitcoin ecosystem a bubble is volatility.

While this is a valid and serious concern, tying the value of cryptocurrencies to tangible and intangible assets would help solve the problem. As cryptocurrency becomes more widely used, consumer confidence should rise, lowering volatility.

Con: Lack Of Regulations

Source: coe.int

Although China has made recent strides in this regard, cryptocurrency is not currently technically controlled and monitored by government agencies such as the US Federal Reserve or any other central bank.

Even if the technology addresses the concerns mentioned above, there will be a higher risk of utilizing cryptocurrency for travel until federal agencies fully approve and control it.

Other issues about technology exist, although they are primarily logistical in nature. As technology advances, for example, it is necessary to change protocols. This type of change might disrupt the normal flow of business and require a long time to implement.

Conclusion

Because there are multiple possible impediments to cryptocurrencies’ widespread acceptance, it’s understandable that experienced investors are currently wary of the technology. Despite this, most people feel that cryptocurrencies (and the blockchain technology that underpins them) are here to stay.

That’s because they provide far too many of the features that users need in a currency, like transparency, decentralization, and flexibility. It’s ideal for use when traveling. Cryptocurrency’s future is likely to be ensured once it hits a tipping point of broad acceptance.