Investors turn to gold as a reliable and valuable asset in times of economic uncertainty. Among the various forms of gold investments, gold bars have always been popular for their purity, liquidity, and potential for capital appreciation. If you are considering investing in gold or any metal bars in 2024, choosing reputable brands known for their quality and that are recognized globally is essential.

Contents

What are Gold Bars?

Gold bars, also known as gold ingots, are rectangular blocks of pure gold. They are highly valued for their purity, liquidity, and ability to serve as a tangible asset. Gold bars are typically produced by refineries and mints, which ensure their weight, purity, and authenticity. They come in various sizes, ranging from small denominations to larger ones, and their value is determined by the weight and purity of the gold they contain. 1 oz gold bars are considered a reliable investment option, particularly during economic uncertainty, as they provide a hedge against inflation and a store of value.

Investing in gold bars offers several advantages:

- Gold bars are highly liquid and can be easily bought and sold globally. They are recognized and valued worldwide, making them a widely accepted currency.

- They offer a tangible asset that investors can physically hold and store, providing security.

- They have a long history of retaining their value over time, making them a potentially profitable long-term investment.

- Gold bars are popular for investors looking to diversify their portfolios and protect their wealth.

What are the Best Gold Bar Brands to Buy for Investing?

The best gold bar brands to buy as investments include Valcambi, Perth Mint, Credit Suisse, Argor-Heraeus, and Asahi. These brands are known for their exceptional art design, recognized global reputation, and high liquidity in the market. Choosing gold bars from these reputable brands ensures quality, authenticity, and potential for capital appreciation.

Valcambi Gold Bar

Source: valcambi.com

Valcambi is one of the leading names in the gold refining industry. Based in Switzerland, Valcambi is renowned for its exceptional craftsmanship and quality. The Valcambi 1 oz gold bars are popular among investors due to their liquidity and recognized brand value. In addition, each bar is stamped with its weight, purity (usually .9999 fine gold), and unique serial number for added security. As a result, Valcambi Gold Bars are highly sought after and can be easily traded in the global market.

Perth Mint Gold Bar

Source: youtube.com

The Perth Mint is located in Western Australia and is one of the world’s most prestigious mints. It is renowned for its high-quality gold products and has a long history of producing exceptional gold bars. The Perth Mint’s 1 oz gold bar is popular among investors who value their investment’s quality and aesthetics. Each Perth Mint Gold Bar is struck with the mint’s famous swan logo and comes with an assay certificate that verifies its weight and purity. In addition, these bars are highly liquid and can be easily traded internationally.

Credit Suisse Gold Bar

Source: nypost.com

Credit Suisse, a Swiss bank with a rich history in the precious metals industry, offers gold bars that are trusted and recognized globally. Investors seek their 1-ounce gold bar due to its excellent craftsmanship and high liquidity. Each Credit Suisse gold bar is sealed in a tamper-proof package and is accompanied by an assay certificate. These features include the Credit Suisse logo, weight, purity, and a unique serial number to ensure authenticity and security. Investing in Credit Suisse gold bars gives investors the confidence to own a product from a reputable financial institution.

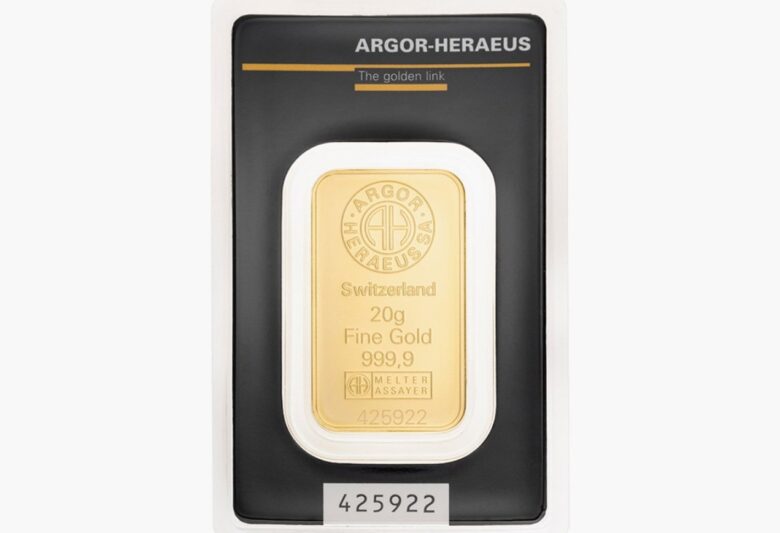

Argor-Heraeus Gold Bar

Source: aurodomus.com

Argor-Heraeus, a Swiss refinery with over 50 years of experience, is known for its exceptional gold bars. Their 1-ounce gold bar is popular among investors seeking a reliable and reputable brand. The bars bear the Argor-Heraeus logo, weight, purity (.9999 fine gold), and a unique serial number. With their excellent craftsmanship and recognized brand value, the Argor-Heraeus Gold Bar is highly liquid and easily tradable.

Asahi Gold Bar

Source: youtube.com

Asahi Gold Bars are highly regarded in the world of gold investment. Asahi Refining, a Japanese company, acquired the gold and silver refining operations from Johnson Matthey in 2015, solidifying its position in the precious metals industry. Asahi gold bars have gained popularity among investors due to their exceptional production standards and global recognition.

The 1 oz gold bars are favored by investors seeking a reliable and reputable brand. Each bar features the distinctive Asahi logo, weight, purity (.9999 fine gold), and a unique serial number. In addition, Asahi gold bars have an assay certificate to ensure authenticity and purity. This certificate proves the bar’s weight and purity, giving investors confidence that they are acquiring a genuine and valuable asset.

Investing in Asahi gold bars offers investors the advantage of a recognized brand known for its commitment to excellence and quality. In addition, with their global recognition, Asahi gold bars are highly liquid, meaning they can be easily bought, sold, and traded internationally. The exceptionally recognized brand value and high liquidity make Asahi gold bars a desirable option for investors looking to add gold to their investment portfolios.

Conclusion

Investing your money in gold bars can be a smart choice for individuals seeking to diversify their investment portfolios and safeguard their wealth. Gold bars offer several advantages, including their recognized global value, high liquidity, and historical wealth preservation. In addition, by choosing reputable brands known for their quality and authenticity, such as Valcambi, Perth Mint, Credit Suisse, Argor-Heraeus, and Asahi, investors can have confidence in the integrity of their investments.

It is essential to conduct proper research, always stay informed about market trends and seek professional advice before making investment decisions. Furthermore, the value of gold fluctuates because of external factors like economic conditions and geopolitical events. Therefore, investors need to stay updated and make informed choices. By considering the best gold bar brands and staying informed, investors can benefit from the stability and long-term value of gold bars as an investment in 2024 and beyond.