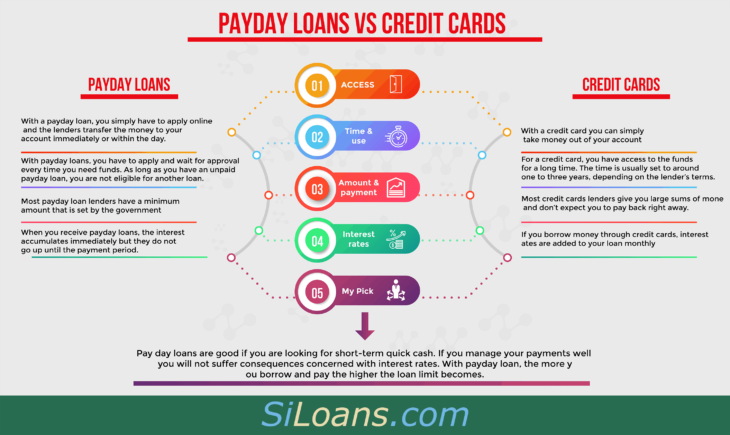

People who are in dire need of quick funds often have two easy options in their hands, namely, credit cards and payday loans.

With credit cards, you can simply go to an ATM and take out the money. Borrowers can apply online for payday loans and get the funds transferred to their accounts in just an hour.

Source: https://siloans.com/blog/credit-cards-vs-payday-loans.html

Some of the major differences between credit cards and payday loans are mentioned below.

- Payday loans feature a 4 percent monthly charge and a 20 percent establishment fee. These fees are considered as interest charged on loan. Credit cards have fees ranging from 1.5 percent to 4 percent and the interest levied on funds used and not repaid is 19 to 22 percent or more.

- Payday loans are available for periods ranging from 2 weeks to 12 months. Credit cards come with an ongoing line of credit; it does not have any set terms with regards to the duration of the funds used. All the terms are mentioned in the credit card agreement.

- Payday loans can be availed by all, even people with bad credit. Borrowers just need to provide documentation about income, whether it is from a regular job or from social security checks, etc. Other minimum requirements include residency and age, etc. Borrowers need to have good credit and be employed to avail of a credit card. Credit card companies require several personal and financial details as qualification criteria.

- Payday loans are short term loans that can be repaid quickly so that borrowers do not accumulate excess debt. The interest rates for payday loans are mandated by state and federal laws. However, it is still higher than interest rates levied on personal loans. Additionally, in case of late payment or non-payment, penalties, fees, and other charges can add up to a substantial amount that has to be repaid.

- Unlike payday loans wherein borrowers need to make a fresh application for every new loan, credit card funds are available to the consumer at all times. You just have to visit an ATM and take out the cash whenever you need it. Cash withdrawn from an ATM is added to the monthly credit card bill. Thus, there is no need for a new account.

- Cash advance from a credit card accrues interest. You can repay the advance immediately and avoid the accumulating interest, or you can repay it as per your convenience along with the accrued interest.

Source: iStock

Both payday loans and credit card cash advances are a reliable and good source of funds in case of an emergency such as car repair, medical bill payments, etc. However, they are not considered to be the best cost-effective method to good financial health. You should opt for these options only when you are sure that you can repay the loan or advance on time and thus avoid getting into a debt trap.