The demand for quality FinTech applications has been growing lately. The peak of investments coming to this business sector was in 2019, so some experts relate it to the pandemic, which closed millions of people at their homes.

Nevertheless, this niche continues growing, thus attracting new investors with fresh ideas. According to Statista, the share of Americans using digital banking has reached 65.3% in 2024, so investing in FinTech app development is a clever decision for an entrepreneur who wants to enter the market of financial services with promising perspectives for the future.

Still, the growing rivalry in the niche requires you to act carefully and apply maximum effort to make your project successful. Today we’ll talk about the key features a quality FinTech app should have as well as share a step-by-step strategy explaining how to build a FinTech app.

FinTech App Features to Include

source:unsplash.com

Like any other application, its functionality and features play a key role in whether it will hit the target and become a market success. The peculiarity of FinTech apps is that they should be as functional as they should be secure. This should be given special attention in the development process.

Here are the eight basic features any type of financial application should have to meet the needs of your customers.

1. In-app registration and sign-in. While many other apps may be utilized without registration, this algorithm doesn’t work with FinTech products. The reason is the security of the user’s assets, so there’s no way you can skip adding this feature to your digital product.

2.Tools menu. With the abundance of features in FinTech apps, it’s a no-brainer you should organize them carefully to make it convenient to use the app. User experience is the main reason you should pay special attention to adding a dashboard to your app.

3. Payment gateway. Can you imagine a FinTech application where you cannot fulfill any financial operations? That’s nonsense, for sure. This is why you should take care of adding one or several payment gateways to your product.

4. Security. This one is critical for this type of app. Users trust their sensitive information to the application and give it access to their financial assets. To protect them from unauthorized intrusion, you should implement solutions that will allow the security of the application. For instance, add two-factor authentication, Face ID feature, data encryption methods, or blockchain technology.

5. Push notifications. It’s hard to imagine a FinTech app without these. Push notifications are a great way to notify app users about any changes in the status of their financial operations. Besides, you can use this tool to your benefit and send personalized offers to the customers.

6. QR code scanning. The practice of using QR codes for financial operations gets more common. Therefore, adding such a feature to your product is a good idea.

7. Customization. UX is what you should have in mind when adding this feature. The more versatile and adaptive your application will be, the better user experience it can provide. Give app users the opportunity to change fonts, backgrounds, themes, and dashboard setups. Give them the freedom of choice they will love.

8. Tips and Explanations. While you should strive to make your app interface intuitive, backing it up with features that allow getting explanations for specific financial operations is advised. This way you’ll make your app convenient and understandable for users of all ages.

How to Build a FinTech App Choosing the Right Strategy

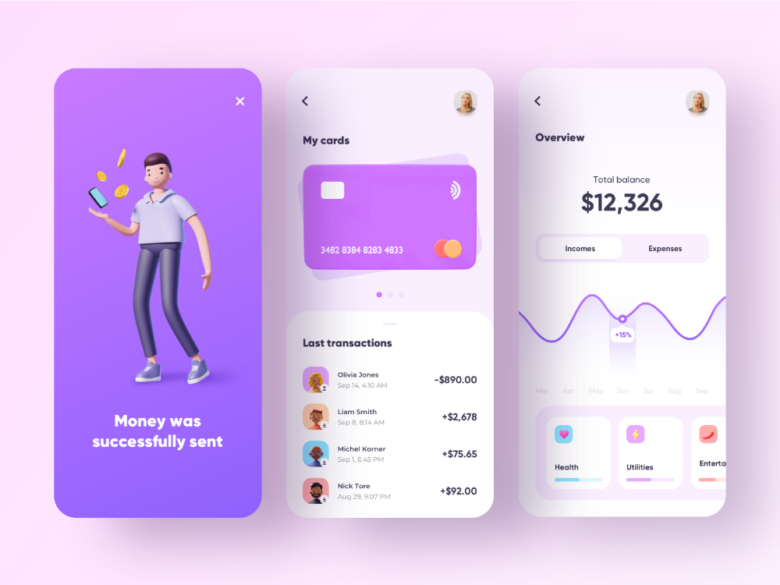

source:pinterest.com

While requiring significant effort on your part, the result will meet your expectations if you take into account every detail important for creating a quality FinTech application. Here is the strategy that should be winning, judging from our experience.

Decide on the App Type

The number of FinTech products you can come up with can make your choice difficult. However, you cannot embrace everything in one app, so you should pick the type you feel works best for you. Your choice can include but is not limited to payment apps, insurance apps, digital banking, personal finance management, and others. Once you make a choice, all your further decisions will strongly rely on it.

Get a Professional Team

People who should implement your idea into a working product should be picked carefully. Only experienced, creative, and dedicated professionals who share your vision of the product should be involved in the process. Whether you cooperate with them in-house, on outsource, or freelance, it doesn’t matter. Their professionalism is the main thing.

Carry out the Market Research

source:filmlifestyle.com

At this stage, the analysts working in your team will analyze the niche you want to enter and the market overall. Also, they’ll do their job analyzing your competitors, defining your target audience, and specifying your product strengths and weaknesses.

Figure out the Legal Issues

The financial sector is regulated by the state, so it has to comply with certain legal requirements. Ensure your app meets those regulations for it to be able to enter the market once it is ready.

Specify the Must-Have Features

When working with your team, you should define what features should be present in your app and what can be skipped. Stay with the must-have list to create a minimum viable product. All the rest can be added later.

Initiate UX/UI Design Process

source:freepik.com

Once you are done with the previous product development stages, your design team can get down to work on your app design. The visual component is as important as functionality, so researching UX at this stage is what should be done. Based on this, you’ll be able to structure the app navigation and get down to UI development.

Develop the Application

The technical part of the app development can be started right after the work on the design is done. In the end, you’ll already get a product that is viable.

App Testing

source:pexels.com

To ensure no bugs and proper function of the application, you will want your team to test the app and eliminate any flaws that will be found.

Presenting Your App to the Market

This is the most nerve-wracking stage of the development process because your project sees the market. It’s time to check user experience with the app, collect feedback, and launch a promotional campaign that will tell the world about your app coming to the market.

Now that you know how much time and effort it takes to build a FinTech app, you can decide whether you want to dive into this. Still, the game is worth the candles, so why won’t you try?