In recent years, Bitcoin has emerged as a transformative force in the world of finance and technology. This decentralized digital currency has not only revolutionized the way we perceive money but has also created vast fortunes for early adopters and savvy investors. In this blog post, we delve into the realm of Bitcoin fortunes and take a closer look at the top holders who have amassed substantial wealth through their investments.

Contents

- The Rise of Bitcoin: A Revolution in Digital Currency

- Early Adopters and Innovators: Pioneers in Bitcoin Wealth

- Institutional Holders: Banks, Hedge Funds, and Corporations in the Game

- Celebrity Holders: Unveiling Famous Faces in the Bitcoin Space

- Billionaires and Millionaires in the Cryptocurrency World

- Bitcoin Whales: Exploring the Dominance of Massive Holders

- Notable Investor Profiles: Strategies and Success Stories of Fortunes

- Security and Storage: Safeguarding Crypto Wealth in a Digital World

- Future Outlook: Predictions and Challenges

- Conclusion

The Rise of Bitcoin: A Revolution in Digital Currency

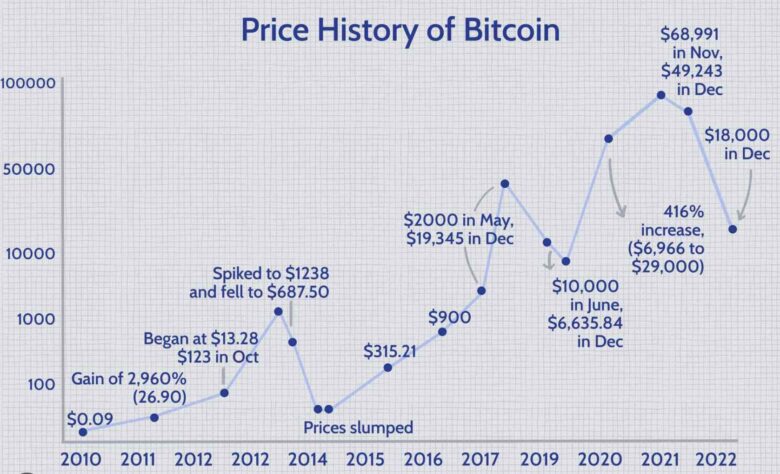

To understand the magnitude of Bitcoin’s fortunes, we must first grasp the rise of Bitcoin itself. This asset, created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto, introduced the concept of a peer-to-peer electronic cash system. Its underlying technology, blockchain, ensures transparency, security, and immutability. Over the years, as stated recently on bitcoin-buyer.io, its value skyrocketed, attracting attention from both individual and institutional investors.

Source: investopedia.com

Early Adopters and Innovators: Pioneers in Bitcoin Wealth

Among the top Bitcoin holders are the early adopters and innovators who recognized the potential of this groundbreaking technology in its nascent stages. These individuals had the foresight to invest in this asset when it was worth only a fraction of its current value. They took risks and reaped extraordinary rewards. Their stories inspire and shed light on the transformative power of Bitcoin.

Institutional Holders: Banks, Hedge Funds, and Corporations in the Game

Bitcoin’s growing popularity has attracted the attention of institutional investors. Banks, hedge funds, and corporations have entered the market, recognizing its potential for diversification and hedging against traditional assets. Institutions such as Grayscale Investments, MicroStrategy, and Tesla have allocated significant portions of their portfolios to Bitcoin, contributing to the expansion of Bitcoin fortunes.

Celebrity Holders: Unveiling Famous Faces in the Bitcoin Space

The allure of this coin extends beyond the financial and technology sectors, captivating celebrities from various industries. Notable figures such as Elon Musk, Snoop Dogg, and Gwyneth Paltrow have publicly expressed their interest in Bitcoin and even become holders themselves. Their involvement brings additional attention to this asset, fueling its widespread adoption.

Source: Bloomberg.com

Billionaires and Millionaires in the Cryptocurrency World

Bitcoin’s extraordinary rise has created a new breed of billionaires and millionaires, solidifying their positions as influential figures in the cryptocurrency world. Visionary investors like the Winklevoss twins, Tim Draper, and Barry Silbert have not only accumulated immense wealth but also played pivotal roles in shaping the perception and adoption of digital currencies. Their remarkable success serves as a testament to the disruptive and transformative potential of this asset and the broader cryptocurrency ecosystem.

Bitcoin Whales: Exploring the Dominance of Massive Holders

Within the Crypto ecosystem, there exist a select group of individuals known as “whales.” These whales hold a significant portion of the total supply. Their actions, such as buying or selling large amounts of Bitcoin, can have a profound impact on the market. Understanding their strategies and motivations provides valuable insights into the dynamics of Crypto fortunes.

Notable Investor Profiles: Strategies and Success Stories of Fortunes

Bitcoin’s volatility requires a strategic approach to investment. Successful investors employ various strategies, including long-term “HODLing,” active trading, and diversification. By examining the profiles of notable investors, we can gain valuable insights into their investment approaches, risk management strategies, and the lessons they have learned along the way.

Source: wsj.com

Security and Storage: Safeguarding Crypto Wealth in a Digital World

Protecting Bitcoin fortunes is of utmost importance in a digital landscape prone to hacking and fraud. Secure storage solutions, such as hardware wallets and cold storage, are crucial to safeguarding holdings. Furthermore, implementing robust security measures, such as multi-signature authentication and encryption, is essential to prevent unauthorized access and ensure the longevity of fortunes.

One common practice for securing crypto holdings is the use of hardware wallets. These devices store private keys offline, reducing the risk of being compromised by online threats. Hardware wallets often employ additional security features, such as PIN codes and passphrase protection, further enhancing the security of holdings.

Cold storage is another popular method used by holders to secure their fortunes. Cold storage involves storing private keys in offline devices or physical mediums, such as paper wallets or encrypted USB drives. By keeping private keys offline, the risk of online attacks is significantly reduced.

In addition to secure storage solutions, crypto holders must remain vigilant against phishing attacks and social engineering attempts. Hackers often target holders through email scams, fake websites, or malware-infected software. It is crucial to exercise caution when interacting with online platforms and to verify the authenticity of any requests for private key information or access to Crypto wallets.

Future Outlook: Predictions and Challenges

One key challenge facing Bitcoin fortunes is the regulatory environment. Governments around the world are grappling with how to regulate cryptocurrencies, including Bitcoin. Regulations can impact the adoption and acceptance of this asset, as well as the ease of trading and conversion into fiat currencies. It is essential for holders to stay updated on regulatory developments and ensure compliance with local laws to protect their fortunes.

Scalability is another challenge that Bitcoin faces. As more people adopt crypto and the number of transactions increases, there is a need for a robust and scalable infrastructure to handle the load. Solutions such as the Lightning Network have been proposed to address scalability issues, but widespread implementation and adoption are still ongoing. Crypto holders should monitor the progress of scalability solutions to assess the potential impact on Bitcoin fortunes.

Environmental concerns surrounding mining have also gained attention. The energy-intensive process of mining Bitcoin has raised questions about its carbon footprint and sustainability. As the world becomes more conscious of climate change and environmental impact, holders may face scrutiny and pressure to ensure their holdings align with sustainable practices.

Source: bbc.com

Conclusion

In conclusion, delving into the world of Bitcoin fortunes and the top holders allows us to witness the transformative power of this digital currency. From early adopters to institutional investors, celebrities, and Crypto whales, their stories and strategies provide valuable insights for those interested in exploring the realm of investments. As the future unfolds, it will be fascinating to observe how fortunes continue to shape the financial landscape and empower individuals around the globe.