Imagine you are attending one of the highly acclaimed Lean Six Sigma Courses, eagerly jotting down notes as the instructor explains the transformative power of Lean Six Sigma Tools. Professionals from various sectors are nodding in agreement, but you, hailing from the financial services industry, find your interest especially piqued.

You begin to envision how these tools could not only simplify processes at your company but also significantly enhance client satisfaction and compliance standards.

This revelation is not just a part of your Lean Six Sigma Training; it’s the beginning of a journey towards operational excellence.

In this blog, we will explore how Lean Six Sigma tools are becoming indispensable and might just transform the financial services sector.

These tools are the key to significant operational improvements, from streamlining process inefficiencies to enhancing customer service and compliance.

Contents

What is Lean Six Sigma?

Source: pcs.udel.edu

Lean Six Sigma combines the waste reducing principles of Lean with the process improvement strategies of Six Sigma. The objective is to minimise variability in business processes and find and eliminate flaws, thereby enhancing the quality of process outputs. Yes, it sounds technical. But don’t panic; discussing its valuable applications in finance will simplify these ideas.

Key Lean Six Sigma Tools for Financial Services

1. DMAIC Framework

Define, measure, analyse, improve, and control—that is DMAIC. In financial terms, however, how does it go?

- Define the problem. What’s going wrong with your loan processing system?

- Measure the present flow of events. What length of time does an average loan application take to handle?

- Analyse the information. Why are there delays? Does it result from lagging credit checks or incomplete applications?

- Improve better with the application of ideas. Maybe automating specific pre-screening programmes or checks could be beneficial.

- Control using post-implementation process monitoring guarantees consistency and sustains improvements.

2. Value Stream Mapping (VSM)

Ever wanted to know where your client onboarding process challenges lie? VSM guides you through the process from beginning to end and identifies each phase where delays arise. Process mapping lets you determine where pointless stages might be eliminated to expedite operations. Have you ever come upon a seemingly unnecessary stage in the process?

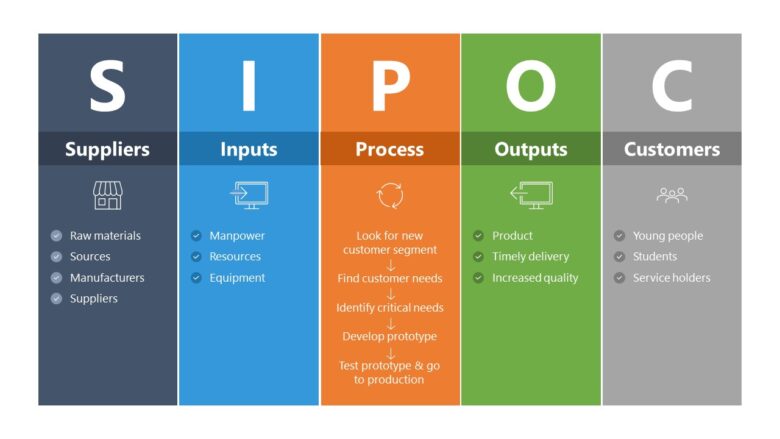

3. SIPOC Diagrams

Source: slidemodel.com

Suppliers, Inputs, Processes, Outputs, and Customers—When working with complicated financial services, SIPOC diagrams offer a high-level summary of a process that is quite helpful. For example, understanding the flow from loan application reception (input) to processing (process) to loan acceptance or rejection (output) might point out areas that want work. Which one would profit from this clarity in your process?

4. Root Cause Analysis (RCA)

RCA lets you discover why mistakes—like incorrect account closures or investment errors, occur. This frequently entails methods like the “5 Whys,” in which you probe “why” several times until you find the fundamental cause. Can you think of a recent problem where this technique might have helped?

5. Poka-Yoke (Error Proofing)

Error Proofing lets you prevent mistakes before they start. For instance, automated alarms for odd transaction patterns can stop fraud, protecting the bank and its clients from significant losses. In your company, how may error-proofing transform risk management?

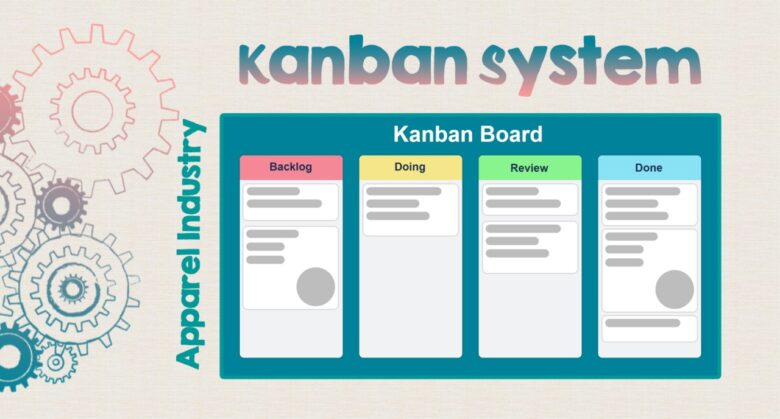

6. Kanban Systems

Source: linkedin.com

Kanban systems transform the management of inventory and workflow within financial operations. By visualising various stages of processes, such as document verification or payment processing, Kanban helps identify bottlenecks promptly.

This system relies on cards or digital signals to represent tasks, ensuring that work progresses smoothly from one stage to the next without overburdening any part of the system. Could this visual method streamline your project management efforts?

7. Just-In-Time (JIT) Production

Just-In-Time production isn’t just for manufacturing; it can significantly enhance financial services by reducing waste and increasing efficiency. JIT in this sector could involve the timely procurement of information, processing of transactions, or compliance checks, ensuring that these services are performed exactly when needed, not before or after. This minimises excess costs and maximises client satisfaction. How might JIT refine your current financial service offerings?

The Benefits of Lean Six Sigma in Financial Services

Improved Process Efficiency

Reducing waste and improving process speed are directly related to cost savings and higher production. Using simplified procedures, financial institutions may manage more transactions without sacrificing accuracy.

Enhanced Customer Satisfaction

Happier consumers result from faster loan approvals, speedier customer service replies, and fewer account management errors. Moreover, satisfied consumers are more inclined to stick to your brand and suggest your offerings to others.

Reduced Risk

Lean Six Sigma lowers the risks connected with compliance and reporting, which are crucial in the financial industry. It reduces unpredictability and mistakes in economic processes.

Increased Employee Engagement

When employees are involved in Lean Six Sigma projects, they often experience increased job satisfaction. This is because they have a direct hand in streamlining processes and solving problems, which can lead to a greater sense of accomplishment and empowerment. Engaged employees are more likely to be productive and committed to the company’s goals, leading to better overall performance.

Greater Flexibility and Scalability

Adopting Lean Six Sigma allows financial institutions to be more adaptable in responding to changes in the market or regulatory environment. By continuously improving processes, these institutions can scale operations up or down with ease, ensuring they are always operating at optimal efficiency without overextending resources.

Sustained Competitive Advantage

Lean Six Sigma not only provides immediate improvements but also helps build a culture of continuous improvement that can sustain a competitive advantage over time. Financial services that commit to Lean Six Sigma practices can maintain high standards of quality and efficiency, making it difficult for competitors to match their level of service and reliability.

Conclusion

Source: corporatefinanceinstitute.com

Would you like to incorporate Lean Six Sigma tools into your financial services methods? Perhaps you have already started and have some ideas or experiences to offer. Either way, we want to know your thoughts on using these tools in your financial processes.

Lean Six Sigma is a road towards operational excellence, not just a toolkit. This approach helps financial services improve their operational effectiveness and competitiveness. Are you, therefore, ready to explore further with The Knowledge Academy and see how these tools might significantly help your company?