Since the creation of its first block in 2020, Solana has gained a lot of attention from crypto-investors, becoming the 16th biggest cryptocurrency with a market cap of $5B. The recent collapse of FTX, however, has significantly affected its price. Now many doubt whether they should convert USDC to SOL as well as other currencies.

Today we will dissect Solana to see how it works, how well it performs, and what is going to happen with the coin in the future.

Contents

What Do You Need to Know About Solana?

Source: analyticssteps.com

Solana is a blockchain platform with its main goal to achieve high transaction speed while remaining stable and decentralized. Its currency SOL at one point had the fifth largest market cap at the time.

Crypto enthusiasts often refer to Solana as an “Ethereum killer.” This is quite a reasonable claim since Solana can create one block of information in 0,4 seconds, while Ethereum needs 10. Moreover, it charges lower transaction fees.

The key feature of Solana is its unique combination of Proof-of-Stake and Proof-of-History consensus algorithms. In PoH the transactions are recorded as events, where each new transaction takes the output of the previous one and uses it as an input for the next hash.

To put it short, this protocol is what allows Solana to boost the transaction speed without heavily relying on hardware.

With PoS the creator of the new block is chosen by staking, the process of locking up crypto holdings to get rewards and earn interest. In Solana’s hybrid consensus protocol, PoS is mainly responsible for validating and monitoring PoH processes. The combination of both provides great speed and scalability.

By leveraging the benefits of both PoS and PoH, Solana aims to address the inherent challenges faced by many blockchain platforms, such as slow transaction speeds and scalability limitations. This innovative combination sets Solana apart as a potential game-changer within the cryptocurrency landscape, attracting attention from developers, investors, and enthusiasts alike.

As the demand for fast and efficient blockchain solutions continues to grow, Solana’s unique consensus mechanism positions it favorably for long-term success. Its ability to process a high volume of transactions quickly, coupled with the benefits of staking and interest rewards, makes Solana an attractive choice for those seeking a blockchain platform that excels in both speed and scalability.

SOL Market Performance

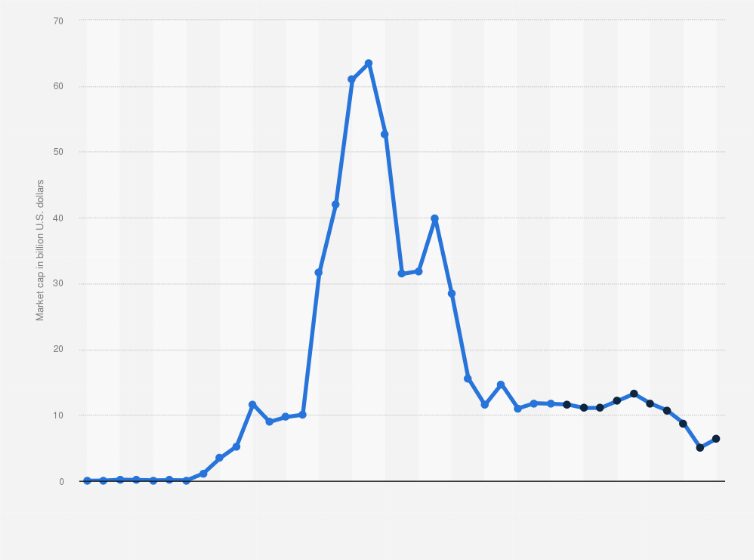

From its launch in April 2020 till November 2021, Solana’s market cap was increasing in a rapid progression. It hit its maximum of $75 billion and started to decline. November 2022 started with Solana’s market cap at $11 billion. As we’re reaching the end of the month, the market cap of SOL is just a little bit over $5 billion.

Solana’s recent decline should be viewed within the context of the broader cryptocurrency market crash that affected numerous digital assets. It is essential to understand that market conditions, including regulatory actions from institutions like the Federal Reserve (FED), can have significant impacts on cryptocurrencies as a whole.

The implementation of regulations and guidelines by regulatory bodies can create uncertainty and hesitation among investors, leading to market-wide downturns. Solana, like many other cryptocurrencies, has not been immune to these external factors and their subsequent effects on market sentiment and price movements.

Additionally, the high level of competition within the cryptocurrency industry adds another layer of complexity. With numerous projects vying for attention and investment, market dynamics can shift rapidly, affecting the perceived value and performance of individual cryptocurrencies.

To illustrate the broader impact, one could examine the conversion history of different cryptocurrencies, such as LRC to ATOM.

Analyzing such conversion histories can provide insights into the fluctuations and interplay between various digital assets, highlighting the interconnected nature of the crypto market.

The recent price drop however was directly related to Sam Bankman-Fried speculation schemes. This, along with the lack of proper regulations caused the collapse of FTX, one of the most well-known crypto-trading platforms in the crypto universe.

Solana Price Forecast

Solana’s current value is about $20 per coin. Despite the FTX fiasco, the crypto experts still predict positive tendencies for Solana in the next years to come. Digitalcoinprice expects Solana’s price to be in the range of $28.61 to $34.10. It could break the barrier, however, but nobody’s sure about that. Priceprediction sets the bar a bit lower: from $22.82 to $25.64.

Looking ahead to the year 2030, multiple price prediction platforms anticipate significant growth for Solana. In fact, many of these platforms expect the price to reach remarkable heights, with projections soaring up to $340.

It is important to note that price predictions in the cryptocurrency market are speculative in nature and should be approached with caution. Various factors, including market conditions, technological advancements, regulatory developments, and investor sentiment, can significantly impact the actual price trajectory of Solana over time.

Is It Profitable to Invest in Solana Now?

Source: finbold.com

The crypto market has been greatly affected by recent events, but still, investors continue to return. Solana’s lost a lot this year, but its value is expected to continue to expand,оne compelling factor supporting the investment potential of Solana is the principle of scarcity. As demand outstrips supply, the resulting shortage typically drives up prices. Given Solana’s previous setback, it is plausible to anticipate a resurgence in its value as market conditions stabilize and interest in the project regains momentum.

Furthermore, Solana’s impressive transaction speed and robust decentralization make it an attractive prospect for long-term investment. The network’s ability to process a high volume of transactions quickly positions it favorably within the broader cryptocurrency ecosystem. As blockchain technology continues to evolve, Solana’s scalability and efficiency may contribute to its continued rise in value.

However, it is crucial to acknowledge the inherently unpredictable and insatiable nature of the market. While Solana exhibits promising qualities, investing in any cryptocurrency entails risks. Potential investors should exercise caution, conduct thorough research, and be prepared to navigate the fluctuations and uncertainties inherent to the crypto space.

Ultimately, the decision to invest in Solana or any other digital asset should be based on an individual’s risk appetite, financial goals, and comprehensive understanding of the market dynamics. Consulting with a financial advisor or experienced individuals in the cryptocurrency field can provide valuable insights and guidance in making informed investment choices.