If you have been engaged for more than five minutes, you’ve probably purchased every current bridal magazine and dog-eared the pages with ideas you swear someone thought up just for you. Before you look at pictures of another celebrity wedding and set your sights on a dress only Beyonce could afford, you need to have a serious talk with your fiancé. This, my friend, is the “How the hell are we going to pay for this?” talk. Maybe you’re assuming your parents are going to foot the entire bill. If they are, lucky you! But chances are, both sets of parents have some assumptions of their own, and you need to know who’s expecting to pay – or not pay – for what. For advice on how to determine this combined wedding budget, The Frisky talked to Aimee Manis, author of 52 Things Brides On A Budget Should Know.

Source: The New Times | Rwanda

Contents

Know the new traditions.

Historically, the bride’s parents paid for everything except the rehearsal dinner, which the groom’s family covered, but this is becoming flexible. “In past decades, the bride and groom were likely to be in their early-20s with little savings,” Manis explains. “In general, today’s couples marry when they are closer to thirty and they’ve had the chance to start a career.” This shift in life situations means many couples are now paying for at least part of their own weddings, if not the whole shebang. Your parents may be delighted to help fund your wedding, but you never know their intentions until you ask. Never assume that they’re paying for anything because of a tradition that’s becoming outdated.

Determine how much you can contribute.

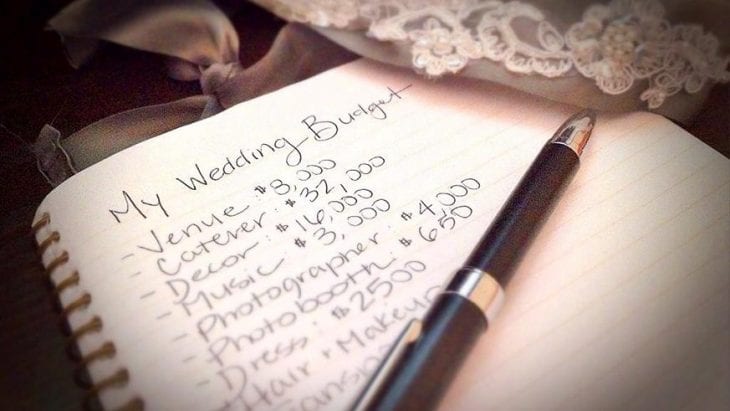

You and your man are a unit now, and however much you put towards your wedding needs to be an amount you agree on. “If talking about money with your fiancé seems overwhelming, start by getting the budget categories down on paper with the help of a wedding planning book or website,” Manis suggests. Showing him the expense of booking his favorite local band and having a full bar will help him understand why weddings can be so expensive. Walking through these categories will help you agree on priorities so you can look at your checkbooks and decide how much you’re willing to invest to get them.

Source: LiveAboutTalk to your parents.

You’re going to have to talk to each set of parents separately, but don’t blindside them at Thanksgiving dinner. While you may have already adjusted to the idea that weddings average $30,000, be ready for everyone else to have sticker shock. “Give your parents some notice, and ask them to set aside some time to talk about your wedding plans. When it’s time for the discussion, start off by telling them how much you and your fiancé can afford to put towards the event,” suggests Manis. They’ll appreciate you starting the conversation by accepting some financial responsibility, and this will open the way for them to indicate what they’re willing to contribute. They may offer to cover only a specific expense such as the wedding cake, so be ready to give them an idea what it will cost. If so, Manis recommends that you present a price range and try to get an idea of where their expectations fall. “There’s much less room for misunderstanding when parents commit to a specific dollar amount.”

Be sensitive to their situation.

Just because your parents can’t fund your dream wedding doesn’t mean they don’t love you, and not being able to spend what they did on your sister five years ago doesn’t meant they’re trying to be unfair. “Much of our parents’ generation has been hit hard by the recession. For those who have watched their retirement nest egg disappear or their monthly incomes shrink, covering the cost of any size wedding may be impossible,” says Manis. Disappointing you may break your parents’ hearts, so don’t make them feel any worse than they already do. Whatever help they offer, remember that it’s a gift and make sure you express how much it means to you.

Source: The Knot

Consider their input.

When either family is contributing, chances are they’re going to expect a say in your decisions. Try to guide the conversation towards your vision, just be ready to compromise. “You can get the ball rolling by giving your input, such as ‘We were thinking a family-style Italian dinner reception at a vineyard,’ and hope that it’s met by a ‘That sounds lovely – whatever makes you happy!’ If instead, the person signing the checks has something else in mind entirely, expect to do some major compromising,” Manis says.

Work with what you’ve got.

“My biggest piece of wedding planning advice for any couple is never go into debt to pay for your wedding,” Manis stresses. “No matter how well-intentioned a couple is about paying off bills with money received as wedding gifts or future work raises, it rarely works out that way.” Yes, your wedding memories will last forever, but the wedding invoices shouldn’t. “Starting off a marriage with debt is far from blissful,” she cautions.

Source: EveryDollar.com

Don’t let stress set the tone.

This is supposed to be a joyful occasion, so guard carefully against money issues preventing it from being just that. “If, for whatever reason, mixing your families and your financial issues turns into a recipe for disaster, take a break and re-evaluate your priorities. Can you think of ways to make your money go further – maybe by changing locations or trimming the guest list?” Manis suggests. Your wedding is important, but it’s only one day. Both sides of the family tree are yours for life, and there’s no sense in letting wedding planning cause resentment years down the road.

Original by Colleen Meeks