Starting something new and expecting it to go smoothly right from the start is very unrealistic and a good way to set yourself up for a lot if disappointment. This is especially true in the world of business. No matter what it is, you have to start off the right way and move long slowly while learning new things along the way. With that being said, in the world of crypto trading, common mistakes beginners make are even more usual and need special attention.

If you are one of the many newcomers to the exciting albeit frustrating world of digital currencies, you probably have a lot of questions and dilemmas about the whole thing. You may have started the whole treading career already but you are probably still confused and have questions about why you are not improving. We are here to help you so do not worry about that. In this article you will get the chance to know about the worst crypto trading mistakes that most beginners tend to make. More importantly, you will get all the info you need to stop making them and do other things instead.

In case you have a wish to learn more things about the world of digital currencies and read about what requires the most amount of attention in trading, make sure to check out www.techtimes.com.

Contents

1. Doing it with real money immediately

Source: unsplash.com

Practice makes perfect, there is no question about it. And when money is concerned, you should definitely practice without it before you can actually do things where you may lose a lot of it. Trading cryptos is a highly skilled thing to learn, a very precise method of balancing information and what to do with the right timing. Therefore, you should first do paper trading and involve real money only when you achieve good results there. Preparing yourself for the real deal with fake money and practicing through all the scenarios is the best way to start and prevent easy-to-miss mistakes beginners almost always make. You will develop strategies and learn about different patterns without spending a dime, but the knowledge you get will surely feel invaluable.

2. Paying high fees

Source: oxspringpaul.com

One of the advantages of cryptocurrencies over traditional money and its systems are the very low fees and the non-existence of third parties looking to take away a percentage of each transaction. So if you are paying high fees during your trading, there is something you are doing wrong. Trading on exchanges that offer low fees on trading is the key factor here because there is no reason to give away so much in crypto trading. Fees between 0.1% and around 0.3% are considered low so stick with the brokers and exchanges that are like this. At the same time, the best of the best offer high volume and liquidity apart from lower fees, so it is a no-brainer to go for the biggest and most reputable places to trade.

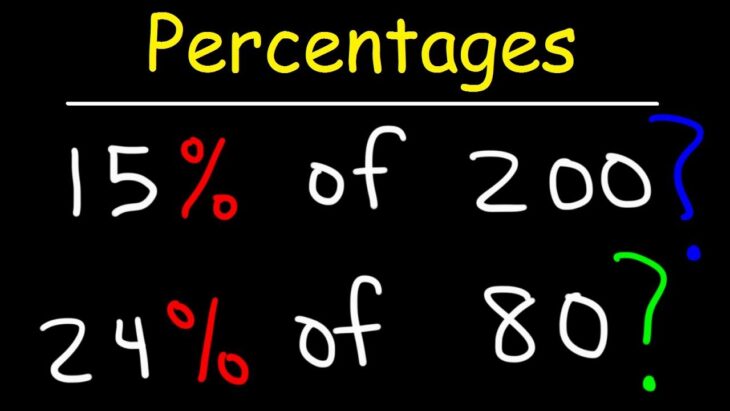

3. Not caring for percentages

Source: youtube.com

A textbook mistake most beginners make without realizing it not seeing their profits and losses as percentage. They would rather view as an absolute gain, which is not the best route to take. It is much safer, easier, and sensible to develop a habit where you will view each trade you make through percentages. This gives you a clearer picture of your losses and profits after the transaction and it is easier to calculate, plan for, and prepare for. If you open any type of crypto or stock market website, all you will see is red and green percentage numbers. It is all about percentages in trading so make use of them if you want to be better and not make mistakes.

4. Trading a handful of currencies

Source: unsplash.com

Keeping all of eggs in a single basket, or even two or three of them, is very unsafe in the trading world. There is now well over a thousand different cryptos in circulation with new altcoins (alternative coins) constantly showing up. It would be a bad business move to only support the big ones like bitcoin or ethereum and not paying any attention to the up and coming varieties. Investing in as many coins as you can is the best way to go because you will always have more than one to rely on and more than on to fall back to when others experience a sudden drop in value. Explore the market and check which ones are on the rise or on the decline and start from there. While you should almost definitely invest in bitcoin for starters, there should also be at least half a dozen others that interest you. This makes trading easier, better, and safer.

5. Doing it all without a goal

Source: unsplash.com

Not having a strategy and a plan, or even the reason for all the trading you are about to do will make you choose poor options and make mistakes far more often than you should. What is the reason you decided to be a part of the crypto world? Why do you want to trade? Is it to only have more money to your name or something else? You have to make a plan before you start and know what to do to get there. Beginners usually do not have one and they join the trading world because they think anyone can do it. While this is true, it only works up to a certain degree and you actually have to know what you are doing day in and day out, else you will be prone to very bad scenarios that could have been prevented. It is all about the trading plan and tactics.

6. Following herd mentality

Source: disturbingtheworld.com

Last but not least, following herd mentality is a double edged sword and you should remember that. While doing what everyone else is doing makes sense because it is what the majority of people does, it can actually turn out to be the bad move and only those who followed their gut feeling and instincts, or even better, their better judgment and logic, prosper. Never fall for what the masses think blindly and always question it on your own. If you have a bad feeling about it or if it goes against what you believe in and what you are about, you do not have to through with it.