Quick question? Have you thought about your credit score lately? If you are like most folks, this is one of the key aspects in your finances. Over the last two decades, American household owners have grown smarter when it comes to finances and it is no wonder then that the Average FICO credit score has hit an all-time high of 704. If you have ever wondered how your financial situation compares to that of other folks in the country, an in-depth analysis of the average credit score in US 2019 is just what you need.

In this article, you will find a simplified analysis of the 2019 Average FICO credit score to help you achieve better control of your finances. Keep reading.

Contents

- First Things First: What is a Credit Score?

- What is a Good Credit Score?

- New Scoring Model 2019

- Average FICO® Score on the Rise

- Average Credit Score by State

- Average Credit Score by Age

- Average Credit Score by Income

- Average Credit Score by Gender

- Average Credit Score by Race

- What Do These Credit Score Numbers Mean?

First Things First: What is a Credit Score?

To most household owners, the mention of a credit score is frightening yet this should not be the case. Simply put, a credit score system is a classification of your borrowing condition. To get a credit score of a specific individual, credit reporting companies determine how likely it is for such people to honor credit obligations.

Img source: thefinancegenie.com

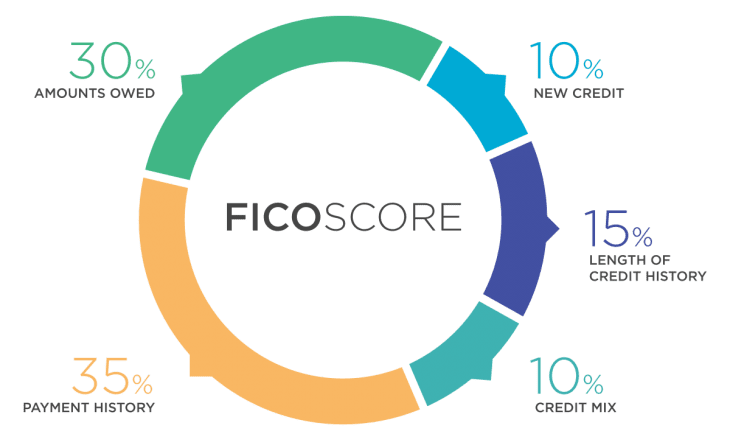

A FICO® Score includes the following:

- Payment history (35%): Most crucial aspect in your credit score indicating your previous and current repayment record.

- Owed amounts (30%): Rates how much of your revolving debt you use every month.

Length of Credit History (15%): For how long have you had credit accounts open?

- New credit (10%): Any recent debt added or in the process of application.

- Credit Mix (10%): How many different types of credit accounts

What is a Good Credit Score?

Credit reporting companies don’t evaluate how much you own but rather how well you manage borrowed funds. A credit score of 670 to 739 rates as “good”, 740 to 799 as “Very Good” and anything higher than 800 as “excellent.”

Consumers with a high credit score have made better credit decisions than those with a lower rating and they have an easier time when it comes to applying for credit and other financial services.

Img source: cnbc.com

New Scoring Model 2019

It is important to note that a new scoring model known as Ultra FICO applies in 2019. In this model, the focus will not only be a consumer’s credit payment history but also the utilization of funds in checking, savings, and money market accounts. It is more about overall financial prudence and not only on credit management.

Average FICO® Score on the Rise

Over the last 10 years, the Average FICO Score has consistently risen hitting a high of 704 in 2019. Back in 2008, the Average FICO Score was at a lowly 690, a reflection of the high amounts of debt most households carried back then.

In 2018, 21% of Americans had an exceptional FICO® Score. On the other end, the number of Americans with average FICO® Scores below 550 has decreased tremendously. By 2018, only 11% of the U.S. population had a FICO® Score lower than 550.

As the economy recovered and Americans got hold of more information about their finances, credit scores have continued increasing. Today, more people understand their credit behavior and the impact of every decision on their score. With ease of access to credit score information, more Americans check their scores regularly as part of keeping tabs on their finances.

Average Credit Score by State

So far, there is no official data about FICO score by states but it is possible to rank these states by the average credit score. Minnesota (709), Vermont (702), New Hampshire (701), South Dakota (700) and Massachusetts (699) lead the ranking in the average credit score. At the bottom of the ranking is Nevada (655), Alabama (654), Georgia (654), Louisiana (650) and Mississippi (647).

Img source: torontostoreys.com

Average Credit Score by Age

With age, people become more financially prudent and it is no wonder that consumers above 60 years have excellent scores. While younger people have to borrow to build their financial foundation, older people have more financial stability and better financial habits.

Average Credit Score by Income

The relationship between income and credit scores is a complex one. On one hand, high-income earners have better credit scores because they don’t rely on loans and they also have higher borrowing capabilities. On the other hand, low-income earners can also attain excellent credit scores if they consistently borrow and repay their debts. The most important thing to note is that credit scores don’t depend on wealth but rather the ability to manage funds.

Average Credit Score by Gender

It is a fact that men in America still earn more than their female counterparts. This, in turn, puts them at a better position for debt approval. From the 2016 Average Credit Score by Gender, men’s average credit score leads the women’s with more than 10 points.

Average Credit Score by Race

In a comparison of race, Asians lead with an average credit score of 745, followed by Whites (734), Hispanic (701) and blacks (677).

Img source: moneycrashers.com

What Do These Credit Score Numbers Mean?

- When applying for credit

When applying for a loan, your credit score comes into play as a crucial factor. With a good credit score, getting credit is easy though their factors such as income, debt to income ratio, free cash flow play a part too. You will have to go for high-interest loans or predatory financing options on the market.

- Credit Card offers

A high credit card score gives you better offers when shopping for credit cards. You can easily get an unsecured credit card but with a poor credit score, you have to do with a more expensive secured credit card.

Well, the Average FICO credit score has hit an all-time high reaching 704 but how does your personal credit score compare?