A Medicare Supplement Plan (also referred to as Medigap) covers some of the health care expenses not covered by Original Medicare, such as copayments, coinsurance, and deductibles. It comes in handy, especially if you have no cash to pay upfront for those extra charges.

You can get a Medicare Supplement Plan from private companies. However, there are plenty of choices, from Plan A to Plan N. With all ten options, you might find it overwhelming to decide which one fits you the best.

- Medigap policies are standardized by letters and must be clearly identified as “Medicare Supplement Insurance.”

- All policies offer the same basic benefits, but some offer additional benefits, so you can choose which one meets your needs.

- In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in different way.

- A Medigap policy covers coinsurance only after you’ve paid the deductible (unless the Medigap policy also pays the deductible).

Source: everydayhealth.com

Contents

Summary of All Medicare Supplement Plans

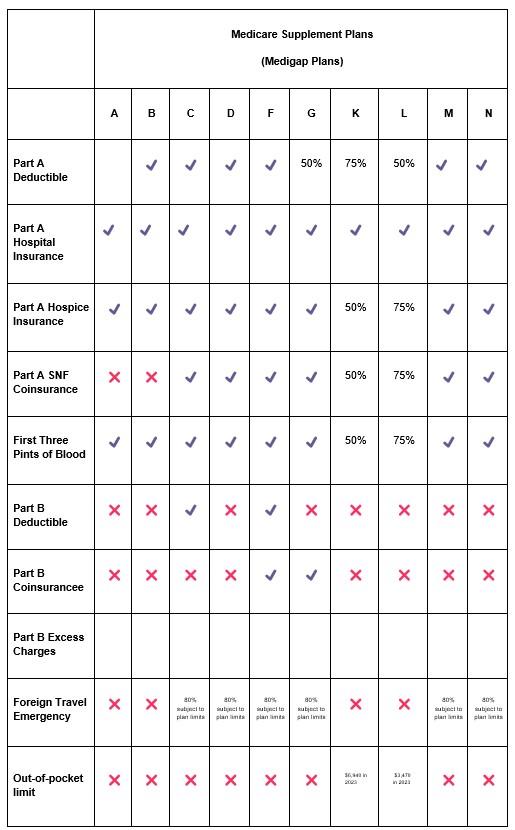

Each of the ten Medicare Supplement Plans in the market offers the following core benefits:

- 100% of Your Part A Coinsurance: Upon exhaustion of your Part A benefits, your supplemental plan can still cover you for an additional 365 days.

- Part B Coinsurance: Plan K pays 50%, Plan L pays 75%, and all other plans pay 100%.

- The first three pints of blood you receive each year: terms are similar to Part B Coinsurance

- Part A Hospice Coinsurance Plan: also same with Part B Coinsurance

Besides covering these baseline benefits, some plans include coverage for deductibles, coinsurance, and excess charges related to skilled nursing facilities. Some plans even offer foreign travel emergency coverage to help cover medical costs abroad.

Here’s a table to help you better understand the benefits you will get from each Medicare Supplement plan:

So, which of these Medicare Supplement Plans are the best?

To determine which Medicare Supplement plan is right for you, you should determine which policy provides the best benefits for your medical needs.

Consider, for instance, how well each plan covers skilled nursing or foreign travel emergencies if you desire coverage in those areas. Further, if you think you will require hospitalization in the future, a plan that pays for the Medicare Part A deductible may prevent you from incurring a large hospital bill.

Here are other plans and how they will best suit you:

Source: kiplinger.com

Plan F: Best for Medicare Qualifiers before January 2020

Medicare Supplement Plan F would be the best if you qualified for Medicare before Jan. 1, 2020. This supplementary plan will cover all items that you would typically have to pay out of pocket, including deductibles and coinsurance.

A comprehensive plan like Plan F will give you peace of mind about day-to-day expenses like copays for doctor’s visits. The average monthly premium for Plan F is $231, which makes it more expensive than Plan G.

Unfortunately, Plan F is no longer available to newly eligible Medicare enrollees after Jan. 1, 2020. But, Plan F holders can continue to receive coverage.

Medicare Supplement Plans in Pennsylvania, often referred to as Medigap plans, provide valuable coverage to fill the gaps in original Medicare. These plans can help Pennsylvania residents with out-of-pocket expenses such as deductibles, copayments, and coinsurance, ensuring they have comprehensive healthcare coverage. Choosing the right Medicare Supplement Plan PA can offer peace of mind and financial security for seniors and eligible individuals.

Plan G: Best for New Enrollees

In terms of coverage, Medicare Supplement Plan G is the best overall plan that offers the most benefits to ]new enrollees. Plan G covers almost everything except the Part B deductible. It means that before your supplemental insurance benefits begin to pay for your health care, you will be responsible for paying the entire Medicare Part B deductible – $233 for 2024.

New enrollees typically choose Plan G as their Medicare Supplement. The rates, however, can be very high, averaging $190 a month. In this case, you should consider the potential annual medical costs you may have with this monthly premium.

Source: singlecare.com

Plan K: Best for those Looking for Cheap Medicare Supplement Plans

Consider Plan K if you’re looking for a Medigap policy that’s as cheap as possible and still offers some extra coverage.

In contrast to many other Medigap policies, Plan K only covers 50% of Medicare Part B coinsurance, blood, hospice care, skilled nursing, and the Part A deductible. Several Medigap plans, including Plan G, provide full reimbursement for these services. However, these plans are far more expensive.

If you don’t think you will need skilled nursing in the future, it’s okay to settle with Plan K. But, if you do, remember that Plan L will only cover 50% of the cost.

Given the less coverage, the monthly premiums for Plan K are much lower. The policy costs about $77 per month, so it’s an affordable Medicare Supplement plan, especially for low-income seniors.

Plan N: Best Alternative to Plan G

If you’re looking for a plan that’s almost as good as Plan G but for a lower cost, Plan N is a good option.

One difference between the plans is that Plan N does not cover Medicare excess charges. A doctor or medical provider might charge you this extra fee if they don’t accept Medicare-approved amounts for health care.

It is possible to avoid this cost by either purchasing Plan G or making sure your medical providers accept the Medicare-approved payment for services. You will save $38 over Plan G by choosing Plan N if you are willing to make this trade-off.

Source: oklahoma.gov

The Verdict?

There is no one best Medicare Supplement Plan- it will all depend on your needs. What’s best for you might not apply to somebody else. So, instead of joining the bandwagon, the best thing to do is list all your needs, research, and compare all available plans. You can start by looking here to select the right plan based on your unique needs.