There are many reasons why a person would need life insurance coverage. Maybe to protect your family, cover a business loan, or to pay off debt obligations. You know you need this valuable coverage, but what if you are one of the nearly 31 million people in the United States alone, who have Diabetes?

img source: healthline.com

You have probably heard myths that people with diabetes cannot obtain life insurance coverage. And if you are approved, that maybe the premiums are ‘sky high.’ In this article, with the help of diabetes365.org we’ll uncover some myths, and share FACTS with you about life insurance for diabetics.

People with Diabetes Can get Life Insurance

Having diabetes, does not automatically disqualify you from obtaining life insurance coverage. It simply means you need to be a little ‘smarter’ when looking for coverage. Says James Peele of Diabetes Life Solutions, “when looking for life insurance with diabetes, a person needs to work with an agent who is trained in this field. Meaning the agent only works with people who have this disease. If the companies website claims they specialize in several medical conditions, they are not specialists, but rather generalists”.

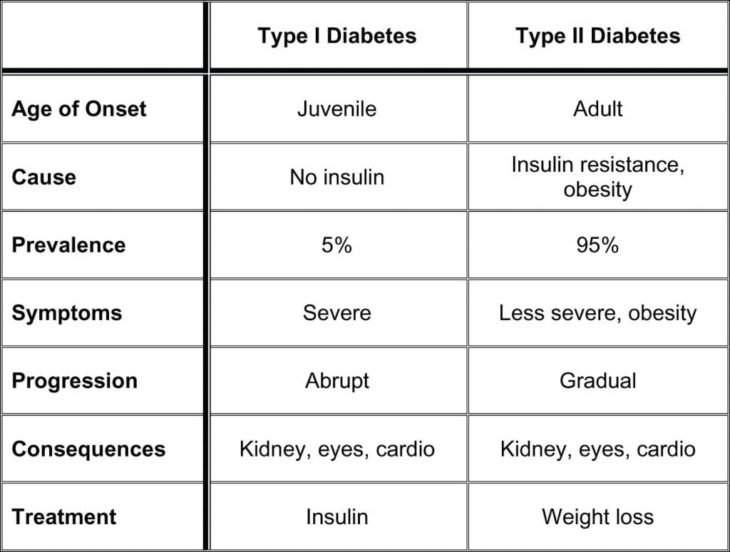

Often times people with diabetes will get misinformation from uninformed agents. This is disappointing but all too common. Life insurance companies have made significant improvements to the offerings they can make, to the diabetes community. People with Type 1 and Type 2 Diabetes can still qualify for the same policies as people without diabetes can.

img source: quantifiedhealth.blogspot.com

Your best to find coverage is to work with agents who can ‘shop’ your diabetes and health profile out to several companies. This will help you find the life insurance carrier that will offer the most competitive rates. Generally, this can lead to thousands of dollars in savings over the lifetime of the insurance policy.

Rates for diabetic life insurance are affordable

Many people continue to think rates for diabetes life insurance are not affordable. In reality, the premiums are. People with Type 2 diabetes often times receive the same types of premiums that people who do not have diabetes receive. They qualify for Standard, and even Preferred rates on a regular basis.

As of 2018, rates for diabetics are at all time lows. Life insurance companies are now able to offer these lower premiums, due to people with diabetes tending to live healthier lives. Many people with diabetes tend to watch everything they eat, check blood sugars regularly, and have a regular exercise regimen.

LIfe insurance companies are even offering discounts to diabetics who will allow the companies to monitor their activity levels. Meaning if you wear a fitbit type of device, and share your information with them, you could be eligible for discounts up to 25%. If you are an active diabetic, this means more money in your pocket!!!

No longer are life insurance companies making life hard, on the 31 million people with diabetes in the United States alone. Life insurance companies are smartening up, and making life insurance affordable.

img source: indiatoday.in

Medical exams are NOT needed for coverage

Many people with diabetes have the misconception that you’d have to undergo blood, and urine tests, to qualify for life insurance coverage. That’s no longer the case! Diabetics can qualify for several different types of term life insurance, and whole life insurance products.

If you are a diabetic, who doesn’t want to undergo these extensive tests, you do not have to. Life insurance companies will provide no medical exam options. To qualify, you’d simply answer basic health and diabetes questions. Companies will also do a prescription drug background check and a Medical Information Bureau review. The findings in these reviews determine your eligibility.

Getting approved for these types of policies take a matter of days. You won’t have to wait weeks for a decision. If you have diabetes and are in a hurry to get coverage, these policies would be ideal for your financial situation.

img source: gob.mx

If you are a person who doesn’t have the best control, of your diabetes, these policies may be the best fit for you. Don’t feel like you have to go thru ‘hoops and hurdles’ to obtain life insurance with diabetes.

People with Diabetes no longer have to worry about the lack of options, when it comes to life insurance. Diabetics have several options. So don’t believe those myths, that diabetics can’t get life insurance, or that it’s too expensive. You’ll be surprised at how inexpensive the premiums truly are!