In the trading industry, “arbitrage” is a well-known phrase. It has been used by cunning merchants for years, profiting from fluctuating market prices. Even if arbitrage is practically nonexistent in conventional stock and foreign exchange markets, the cryptocurrency sector has maintained this practice due to the lack of standardisation on the global landscape.

One of the most fascinating examples of crypto arbitrage is the Kimchi premium, examined in this essay. This new arbitrage method is unique to the South Korean market and is an excellent example of how rules and regulations significantly impact the crypto market.

Source: tradesanta.com

Contents

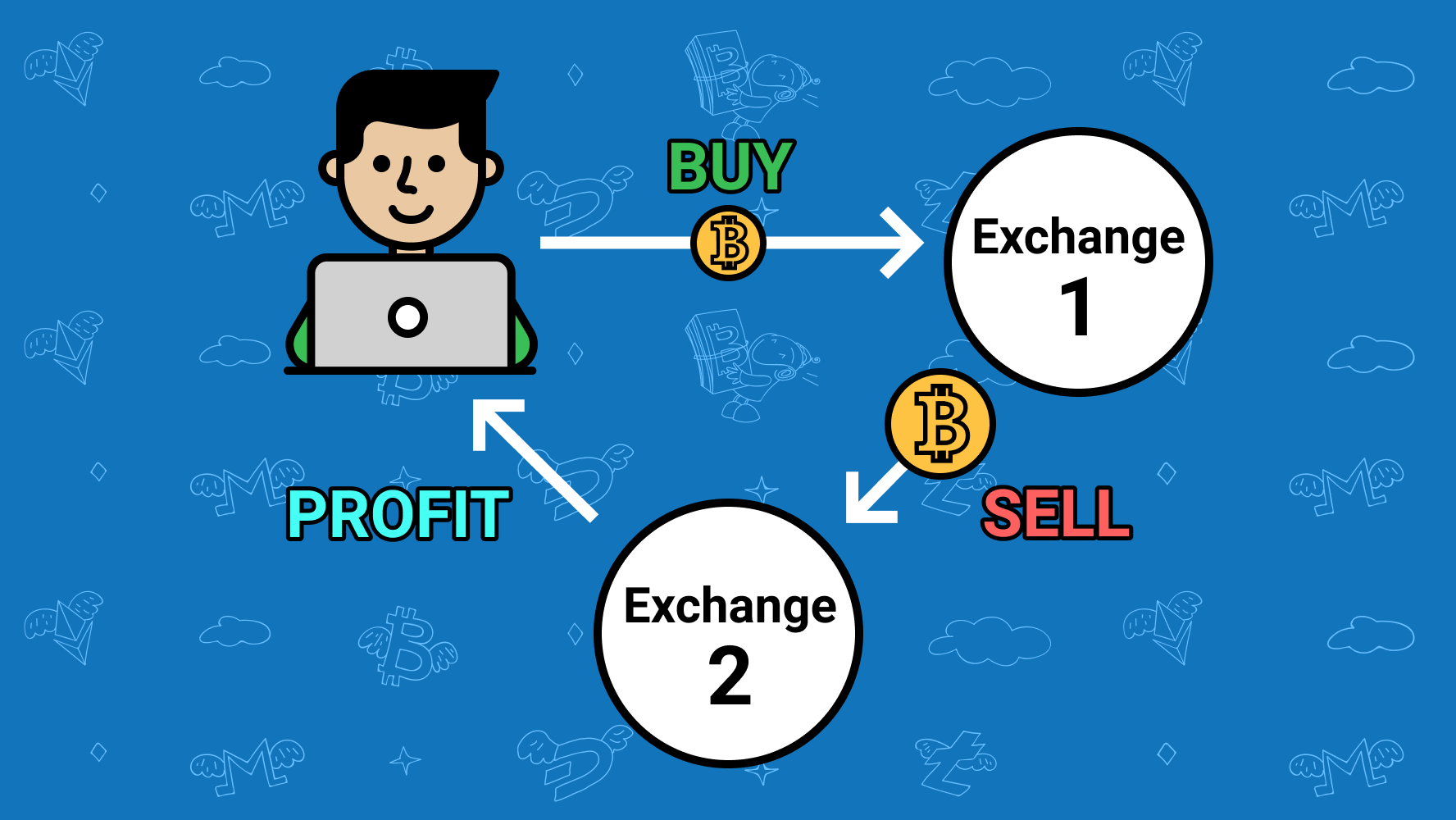

How Crypto Arbitrage Works

The technique of identifying a price differential across exchange markets and profiting by buying cheap and selling high is known as crypto arbitrage. Let’s say, for example, that trader X finds out that the value of Bitcoin is ten ethers in one market and twelve ethers in another. To turn a profit, Trader X has to purchase Bitcoin in the first market and sell it immediately in the second. If all goes as planned, trader X will profit from the difference between the two deals and no losses.

It makes sense that, because of so many limitations, arbitrage is now banned in most trading venues and all but impossible. The majority of trade sectors, including commodities, equities, and fiat money, have completely stabilised on various exchanges, drastically reducing or even eliminating arbitrage opportunities.

However, the cryptocurrency market is a whole other story. The crypto environment is still quite vulnerable to arbitrage practices because it lacks established regulations and unified standards. One of the market’s most remarkable instances of feasible crypto arbitrage is Kimchi Premium.

Defining The Nature of Kimchi Premiums

Named after delicious Korean food, South Korean traders developed the Kimchi premium to symbolise the unique arbitrage possibilities in this local market. The Kimchi premium possibility was initially made accessible in 2015 when traders realised that Bitcoin and other cryptocurrencies sold at considerably higher prices on South Korean exchanges. This significant price disparity results from the stringent ways the South Korean government monitors money flow into and out of the country’s economy.

Historical data shows that in the Korean cryptocurrency market, the price of Bitcoin is always higher compared to international standards. But because other top cryptocurrencies are more in demand in the Korean market, Kimchi premiums aren’t solely linked to Bitcoin. Ethereum has recently demonstrated excellent premiums in the Korean market, proving that Bitcoin is not the only viable arbitrage option.

Source: corporatefinanceinstitute.com

Why Is Kimchi Premium Possible?

Simply put, the rules and regulations of South Korea effectively cut off the nation’s economy from the rest of the world. The government closely monitors domestic markets to ensure that domestic monies stay inside South Korea’s borders and that South Korean investors are kept off foreign exchanges. South Korea has the tightest regulations even though other countries have similar trade restrictions on their internal markets.

The Korean government consequently created a separate domestic commercial market. Due to its lack of integration into global markets, Korea’s supply and demand for tradable assets differ from those of the rest of the world. Therefore, the Korean market offers one of the last great opportunities to participate in substantial arbitrage in bitcoin and altcoin trading.

The Inner Workings Kimchi-Related Arbitrage

In what way is Kimchi premium arbitrage conceivable, considering that the Korean government prohibits foreign exchange transfers? The answer lies in the anonymity and decentralisation of blockchain technology. Unlike traditional markets, it is still challenging to identify or manage money movements on blockchain networks. As a result, despite official attempts, overseas traders may still access Korea’s cryptocurrency market, making it one of the few remaining opportunities for arbitrage—albeit at a cost.

In 2024, kimchi arbitrage is still relevant. It is by no means an easy task, though. As previously said, selling kimchi premium doesn’t have to be unlawful or impractical. Still, it does necessitate traders to go through a challenging procedure that not everyone can carry out properly. The most prominent challenge is breaking into the domestic Korean market and finding reliable channels for transaction execution. Although the kimchi arbitrage has been published online, having the right connections to engage with the Korean crypto sector is critical.

Furthermore, Kimchi premium is not always viable due to unfavourable pricing discrepancies, despite its stellar reputation. Kimchi premium has seen dramatic price reductions in recent years, matching or surpassing worldwide price quotes. Nonetheless, Korean citizens continue to rely on cryptocurrency rather than traditional cash reserves because of the persistent political unrest in this area. Thus, Kimchi Premium remains one of the final strongholds of cryptocurrency arbitrage, even in the face of sporadic declines.

Source: usdtpro.asia

The Underlying Process Of Conducting Kimchi Arbitrage

When approaching this intricate situation, several factors must be considered. First of all, the entire process has a lot of technical and logistical complexity. Because the rules governing the movement of funds are enforced to the highest degree possible, accessing the Korean market is exceedingly difficult. To strengthen its defences against such operations, Korea has implemented several regulations about money laundering and unlawful transactions.

Consequently, the most challenging part of this procedure is figuring out which connection channels are appropriate and trustworthy for doing business with. It is also not a good idea to perform this task by hand. The price of kimchi varies from hour to hour. Hence, to avoid suffering significant losses, automated trading bots and analytical tools will assist you in determining the ideal transaction windows. Precise arbitrage is significantly simpler to carry out with automated support. After all, arbitrage requires massive trading volumes to be profitable, and if done manually, this process might lead to significant losses.

Final Takeaways

The practice of cryptocurrency arbitrage is declining rapidly around the world. Government organisations and the biggest cryptocurrency exchanges are working together to eradicate price disparities among markets completely. However, South Korea may be an interesting exception to this trend because of its unique political and economic conditions.

Even if kimchi premiums pose a technical challenge, they can still be highly lucrative for persistent merchants. It will be interesting to see if this odd phenomenon singlehandedly maintains some form of an arbitrage market or if it completely vanishes in light of heightened regulatory measures.