The crypto market is evolving each day. One of the most significant ways digitalization has taken online trading by storm is the creation of crypto trading bots. The trading bots allow you to trade any asset like a professional. This has increased the efficiency of the crypto market since you don’t need experience or extensive knowledge of the market to become a professional trader or sell an asset.

Contents

What are Crypto Trading Bots

Source: coingape.com

Crypto trading bots are software programs that use algorithms to analyze the cryptocurrency market and make trades on behalf of the user. Traders can use a Crypto Trading Bot to execute trades based on predetermined criteria, such as the movement of specific cryptocurrency prices or the execution of certain technical indicators. You can also automate a wide range of trading strategies, from simple buy-and-hold to complex algorithms that account for market conditions, the depth of the order book, and trade history, among other things. While you can use some to automate fully, others offer a hybrid approach that allows you to set your parameters and make manual trades.

1. 3Commas

One of the best-recommended crypto trading bots allows you to build automated trading bots while trading with them on significant cryptocurrency exchanges. These trading bots are flexible, user-friendly, and affordable. This makes it an excellent choice for trading bots if you want to use complicated strategies and are a beginner or an independent trader.

Some of the features of 3 commas you can enjoy are:

- It supports over 16 major exchanges.

- It has paper trading, portfolio balancing, portfolio management, trader diary, and crypto signal bots.

- Offers other bots’ settings.

- Backtesting and custom Tradeview features are available.

2. Pionex

Pionex is a cryptocurrency exchange in Singapore that allows you to register for free and access 15 free trading bots. Using these bots, you can automate your assets to check automatically into the market without needing API integrations or checking your computer constantly. It is a user interface and has several features, including:

- A free trial plan for retail investors and a $1288 trial fund free.

- It offers 16 free bots for retail investors.

- It offers the lowest trading fees of 0.05%

- Spot-futures arbitrage bot can potentially help retail investors generate passive incomes at low risk.

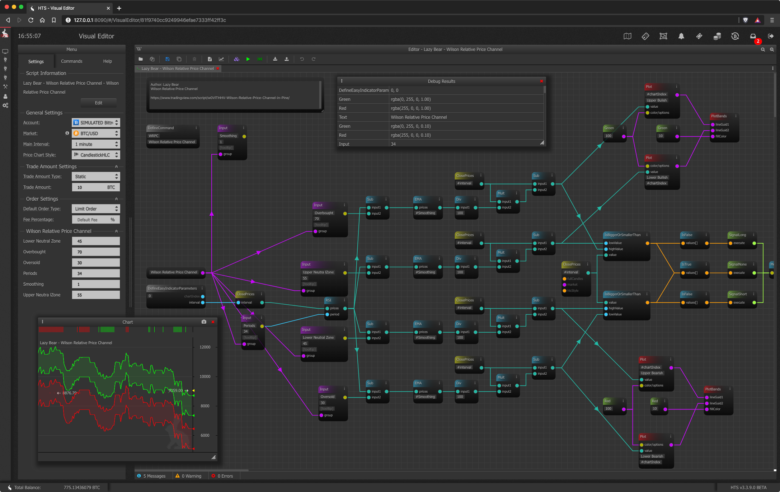

3. Haasonline

Source: haasonline.com

This is also one of the most popular crypto trading bots designed for use with major exchanges like Binance, Kranken, and Bitfinex. Most professional traders in forex and stocks use it to maximize their trading. It offers a free trial period, a monthly subscription of $19.99, and supports over 36 exchanges. It is also available for various operating systems, including Android, Windows, Mac, and Linux. HassOnline is cloud-based and allows you to use its tools anytime on any compatible device.

Some of the available features include:

- It generates a real-time performance report

- Supports trade over multiple cryptocurrency exchanges, which you can efficiently manage using its Inter-exchange Arbitrage.

- It allows you to make several trades with no exchange restrictions and zero trade fees.

- It also provides custom dashboards to monitor your trading bots and price fluctuation.

4. Cryptohopper

One of the best-known Cryptohopper trading bots is the market-making bot. You can use the Cryptohopper marketplace to design your trading techniques and mimic those of others. You can also purchase third-party services, including cryptocurrency alerts, trading plans, apps, and templates, on the CryptoHopper Marketplace. It uses fifteen cryptocurrency exchanges, including Binance, Coinbase, Kraken, and Huobi, just to name a few. Some of the features of this trading bot are:

- Provides quick automatic trading and portfolio management for 100+ cryptocurrencies, including Bitcoin, Ethereum, Solana, and others.

- Offers several trading tools such as backtesting, customizable technical indicators, saveable templates, and trailing stops.

- It has an advanced strategy designer with over 30 indicators.

- It is web-based and does not support desktop or mobile apps.

5. Coinrule

Coinrule is best for both beginners and professionals. It offers a free demo to try out its features before you commit. You can enjoy several features and customization options, and it works with multiple cryptocurrency exchanges like HitBTC, Binance, Bitfinex, and Huobi. The ability to build up rules-based transactions so that deals are executed automatically according to the predefined criteria is one main perk of Coinrule. In doing so, you can trade much easier and quicker than when you manually enter orders. Check out some of its features:

- Best for mobile-Android, and IOS apps besides web interface

- Allows you to use Tradingview to share trading strategies

- Compatible with multiple crypto exchanges

How to Choose the Right Bot

Source: coinculture.com

Selecting the right trading bot for cryptocurrency can be a daunting task. With so many different options available, it can be difficult to know which one is best suited to your goals and level of trading experience. Here are some tips to help you make an informed decision when selecting a bot:

- Choose the type of trade you prefer. Do you prefer high-frequency automated trades or more volume-based trades? Different bots offer different strategies, depending on what type of speculation you’d like to make.

- Look for bots with features that meet your needs. Some may offer automated order types or integrated technical indicators for more sophisticated strategies. If possible, check out reviews if you want to gain an understanding of a specific bot’s track record and capabilities.

- Check out the user interface. Make sure the trading bot’s user interface is intuitive and easy to understand before investing any money in it. Many platforms allow users to experiment with their bots in demo mode before going live, which gives users an opportunity to get familiar with the different features and functions of the software before fully committing resources.

- Consider the pricing/costs of running a bot. High-frequency/volume traders may find that subscription fees quickly add up – particularly in regions where costs such as electricity usage come into play (profits slim down substantially after factoring out these costs). You’ll want to determine in advance whether using a bot is cost-effective for your chosen strategy and region so that you aren’t surprised by unexpectedly high fees later on.

Conclusion

You can use trading bots if you want to trade cryptocurrency but don’t have the time or expertise to do it manually. However, it is crucial to understand that trading bots carry inherent risks and are not guaranteed to be profitable. Understand the risks involved before using them and maximize your trading potential with one with the most beneficial features.