It comes as no surprise that housing costs are the single-biggest expense faced by people across the United States. Depending upon where you live, housing costs can easily devour your income, particularly in urban metropolises like New York and San Francisco. The problem with unaffordable housing is that it creates an untenable lifestyle. The more you spend on housing, the less you have available actually to live your life. Economists state that the maximum you should be spending on housing is 30% of your gross income. If you earn $10,000 per month, you should spend no more than $3000 on housing costs. As a renter, that figure should include your utilities as well. As a homeowner, that figure should include maintenance, property tax, and mortgage interest, et al.

The US Government has been using the 30% rule for almost 30 years. Anyone who spends more than 30% of their gross income on housing is deemed cost-burdened, and if that figure rises above 50%, the individual is deemed severely cost-burdened. However, the actual figures are subject to leeway, depending on the overall level of debt you may have. For example, the amount you can afford to spend on mortgage or rental expenses can rise as high as 41% if you are debt-free. Various other stats are bandied about, such as the 28%/36% rule which states that housing costs should account for no more than 28% of your monthly gross income and your overall debts are limited to 36% of your gross income. These numbers are more than guidelines; many mortgage brokers will assess your ability to repay a loan based on the 30% rule, or the 28%/36% rule. Those who don’t fit into this category may be subject to much higher rates.

Source: economictimes

How to Cut Your Housing Costs Without Sacrificing Quality of Life?

Downsizing is clearly a viable alternative when it comes to reducing your monthly housing costs. A family accustomed to living in a 2000 ft.² property may consider necessary when there are children living at home, but extravagant when empty nest syndrome hits. In this case, it makes sense to reduce overall expenditures by cutting the square footage to a reasonable size and reducing overall monthly expenses accordingly. For those who are just starting out or those on a much lower budget, things get a little trickier. Given that most developers today are inclined to construct expensive apartment complexes for rental purposes or beautiful new freestanding homes or townhouses in exclusive neighborhoods, it can be challenging to find luxurious accommodation at cut-rate prices. Fortunately, it is still possible to source high-quality housing at affordable prices.

Many notable projects abound such as 960 Howard Street, 1919 Market, and 316 12th Street in California. These affordable, luxurious, and desirable new developments by Danny Haber are considered premium products with aesthetically beautiful décor, fixtures, and fittings. As demand for affordable, high-class living grows, these types of projects will become more readily available to a mass-market of renters and homeowners. There are many exciting new design processes taking place which use innovative technologies and systems known as Magic Walls. These flexible wall systems can divide a pre-existing space into multiple bedrooms, bathrooms, lounges, dining rooms, et cetera.

By maximizing space and minimizing cost, it is possible to have a two-bedroom, two-bathroom apartment even if it occupies 800 ft.² – 1000 ft.² of space. Shared amenities are another great way to cut costs. Rather than having a private swimming pool and Jacuzzi with all the maintenance work and costs, shared communal access is tremendously appealing to many people nowadays. For example, there are many Oakland, California projects taking place with existing buildings being redesigned and redeveloped into luxury-style living at cut-rate prices. It is certainly worth considering options in the adaptable space market where live/workstyle settings are gaining traction with individuals and families. One such example is the 674, 23rd Street complex which features a sky deck, amenities courtyard, and a roof deck.

Source: moneycrashers

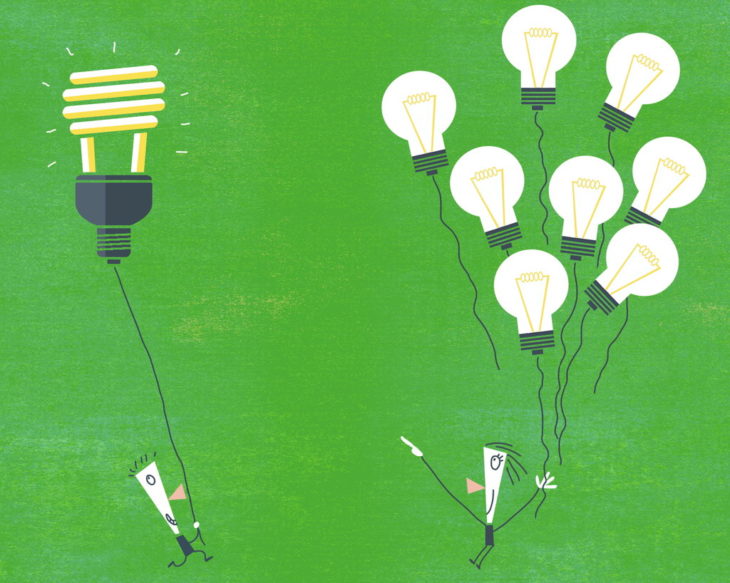

Greater Energy Efficiency Dramatically Reduces Costs

Energy efficiency is often overlooked as part of overall living expenses. It can be something as simple as switching out standard light bulbs in your house, or even halogen bulbs, for LED bulbs. The cost savings per year are substantial, particularly when you make changes across the board. Even greater cost savings can be enjoyed by energy-efficient air conditioning units. The advent of smart systems allows homeowners and renters to download apps and manage AC cooling and heating from a mobile device. The US Department of Energy recommends sealing your home to ensure that cold air remains inside and that the temperature is maintained. Another high-energy usage area is the boiler. By reducing the temperature to around 120°, energy usage will decline alongside costs.

Utility bills appear to be fixed, but they are actually variable expenses for most people. This is particularly true of electrical usage. By unplugging all devices when not in use, you can cut down on electricity usage, with cost savings that can be channeled towards lifestyle improvement, savings, or retirement. There are many devices which tap into your electric usage on a monthly basis, notably kettles, toasters, microwaves, gaming consoles, computers, charging stations, lamps, and so forth. When these devices and systems are unplugged, they are not a cost burden.

Source: nytimes

Viewed in perspective, it is important to adhere to the 30% rule, or the 28%/36% rule when considering your costs of housing relative to your ability to afford a particular lifestyle. Additional cost savings are possible, and necessary for those wanting to plan for retirement, save up for a rainy day, or enjoy a vacation. While housing costs are but one component of living expenses, most of the expenses are incurred within the residence, such as water and electrical usage. These failsafe tips can reduce costs and provide you with greater financial freedom.