Between HUD tightening reverse mortgage guidelines and some reverse mortgage myths that many borrowers have believed, I think now is a very good time to put out a little guide to help borrowers manage their expectations about reverse mortgages.

The reverse mortgage is a federally insured loan. It is not a government grant and although the requirements have always been much easier than most standard or forward loans for qualification, HUD has recently tightened up the program parameters and they have announced that the qualification criteria will be even more stringent with financial assessment guidelines for all borrowers.

Source: charlottesreaders.com

According to reverse mortgage industry expert Michael Branson the key for some borrowers and how they will perceive their reverse mortgage experience is managing their expectations from the beginning. Borrowers who have not ever applied for a government-insured loan (FHA or VA loan) or who may not have gotten a home loan within the past 5 years are often surprised at the level of paperwork and documentation requirements that lenders and borrowers routinely adhere to in today’s lending environment.

After the mortgage melt-down that began in 2008, several pieces of legislation passed that changed the scope of lending. Borrowers’ identities are now verified far more than ever before, lenders are responsible under federal laws for anti-money laundering, laws are in effect that prevent the same level of communication that we once enjoyed with appraisers and generally documentation requirements for many programs are much greater than ever before.

The reverse mortgage program currently does not require the same level of documentation as many lending programs for refinances, but some of the options offered in the reverse mortgage programs do call for similar underwriting requirements.

According to reverse.mortgage one such example is the purchase reverse program. The requirements for verification of funds mirror those for standard purchase loans and HUD requires additional documentation of income when borrowers are retaining a current dwelling to be certain that the borrowers can afford the expenses of the additional property.

Source: Jack Frog/Shutterstock

We have had great success closing purchase reverse loans, but borrowers need to know that they will be called upon to supply this documentation. Some borrowers feel that their lender is “prying” when they ask to see all pages of bank statements, but this is a common requirement for all borrowers.

Borrowers who wish to retain an existing dwelling are called upon to supply tax returns and any time tax returns must be obtained, borrowers will be required to sign a 4506-T form which gives the lender an opportunity to audit the information. It is not because your lender does not believe you, this is a requirement of lenders if they wish to maintain their approvals with HUD and secondary sources. Lenders must have an acceptable written Quality Control program in place before they can even get approval from HUD or any other agency and the ability to verify is part of that program.

Much of the mortgage market and housing meltdown occurred due to rampant fraud in the loans. Now lenders are required to verify all information given to them. Your lender is not “calling you a liar” if they have to perform an audit on your documentation nor are they questioning your integrity, they must perform both pre-closing and post-closing audits just to stay approved with various government agencies and to sell loans in the secondary market.

If you understand that all borrowers have been supplying this information for years now and that all lenders are required to verify the information, then you’ll also understand that lenders are doing the job they need to do in order to ensure that these lending products will remain available.

Source: Small business loans

Lenders must verify the source of all down payments and that the funds are not borrowed. If those funds are in one account and have been for more than 3 months with no recent large deposits, that verification process is much easier. If they have been moved around, then the lender must track the movement of the funds.

The only way to determine that there are no borrowed funds is by acquiring all pages of each statement. Your lender is not interested in which stocks you own or how you invest, but if your funds come from a stock account, all pages of that account statement will be required.

We have actually had borrowers who have become angry when asked for the supporting documentation required by HUD to complete a reverse mortgage purchase, thinking that they either shouldn’t have to comply or that the requested items were “made up” by some underwriter on a power trip! This could not be farther from the truth, but borrowers should understand the expectations of the reverse mortgage in advance or they will drive themselves crazy during the process.

Source: nextviewloans.com

Firstly, remember that if you are applying for the Home Equity Conversion Mortgage (HECM or “Heck-um”) loan, this is a government-insured loan and therefore lenders must meet a minimum of HUD requirements or the loan will not be insured. Without the insurance, the only reverse mortgage that borrowers could receive would be a proprietary loan which is not currently available and when they are, they are typically more expensive and have historically given less money to borrowers (up to the HUD limits). Even the proprietary products utilized standard underwriting guidelines for many aspects as well though.

If you have any apprehensions about supplying documentation to your lender, ask those questions in advance. The reverse mortgage purchase is an easy and relatively fast process for most borrowers but if your expectation was that this loan is one that is an automatic approval with no documentation required under any circumstances, then your expectation is not reasonable, and you will be sorely disappointed.

Also remember that if your circumstances change mid-loan (i.e. you were selling a residence but decided to keep it), that doesn’t mean that you now will not qualify for the reverse mortgage but it might mean that your lender may have to request additional documentation based on the new circumstances.

Source: loansolutions.ph

Contrary to the belief of some, no lender likes to go back and change approvals or request additional documentation, but if the circumstances change, it can’t always be helped. A positive attitude and a spirit of cooperation can usually resolve most requests in just hours.

Your reverse mortgage purchase should be an experience that you walk away from feeling happy that you were able to buy your new home, without paying all cash and with no monthly mortgage payments for as long as you live in your home. The last thing that borrowers or lenders want is a stressful situation simply because the expectations for a reverse mortgage are different than the actual process. Don’t be afraid to ask questions, even before you begin a loan application.

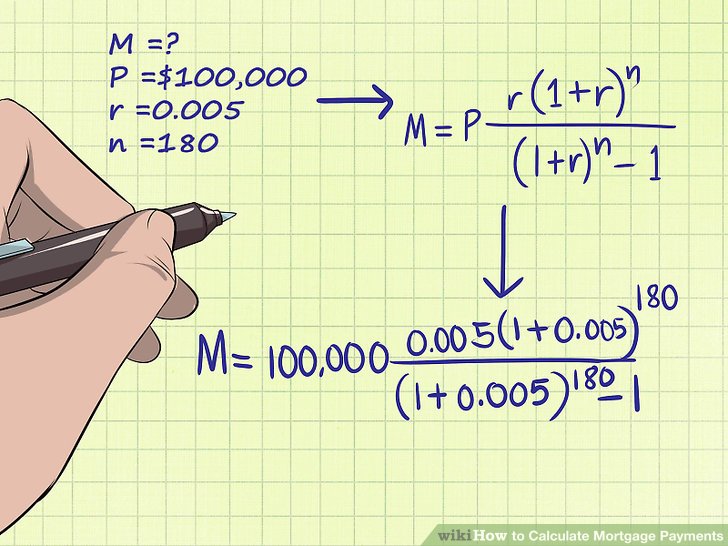

Source: wikiHow

If you’ve never applied for a loan that’s part of a government-insured lending program or you haven’t had any type of home loan in the past few years, there may be some stark differences from the last loan you apply for, but most borrowers complete the purchase reverse mortgage easily and happily. It’s all about expectations and when you understand the process, this can be a fantastic way for seniors to buy a home.