For sending money to India from abroad was like a big question. The question arises like, whether they will get the money? Want to pay extra charges for sending money? Can I send money with the secured transaction? So many questions will pop up. But nowadays money transferring has become much easier and secure. According to experts from MoneyTransfers.com

Contents

These are the Top 5 money transferring websites you can rely on for sending money to India:

1. CrossLinks

Crosslinks is one of the top best online money transferring websites you can trust & count on without any doubts. They can send your money to any bank across India from anywhere at any time. They are providing the first transfer free of cost for new customers, they will not ask for extra promotional charges. With thousands of happy customers, they are providing fast delivery options.

Exchange rates are very low compared to other online service providers, and there are no hidden charges. They offer everyday special exchange rate for your convenience. For creating an account, you need to go through a very simple identification process and can send your money without any delay. For sending money from Canada to India, you can choose Crosslinks for a fast and secured online transaction. They are providing tracking option to check where your money reached.

WHY CHOOSE CROSSLINKS?

- Easy transaction

- Secured and safe transaction

- Fast delivery within Minutes based on your payment mode.

- Track your transaction

- 100% customer support

- No hidden charges

- Get exchange rate alert via SMS/Notification.

- Lock in your convenient rate and send money.

- Exchange rates are the best

- First transfer is free

WHY NOT TO CHOOSE CROSSLINKS?

- Services are currently operation from Canada only.

2. Remit2India

Remit2India has been ruling in the money transferring world for over 16 years. They are providing a secured transaction of money to your loved ones in India. For creating an account in Remit2India, you need to submit your ID cards and all required information.

They will handle your international transaction and currency conversion; you don’t have to worry about that. Your transaction will occur locally no matter what kind of payment mode you choose, it will convert into currencies and send it to the recipient.

Source: Remit2India

WHY TO CHOOSE REMIT2INDIA?

- Easy Transferring mode

- Safe Transactions

- Good customer support

WHY NOT TO CHOOSE REMIT2INDIA?

- Delivery time is slow

- Exchange rates are a bit higher

3. WesternUnion

Through WesternUnion you can either use their app as well as wu.com for money transferring. You can send money using your credit or debit card or either with cash. They have many branches all over India, so it will be convenient to receive the money.

Exchange rates are higher comparing to others. You can track your transferring to know where it is reached. Customer support is not available when it is needed, will take some time to reach with the support team.

Source: WesternUnion

WHY TO CHOOSE WESTERNUNION?

- Safe transactions

- Can Track your money

WHY NOT TO CHOOSE WESTERNUNION?

- Exchange rates are higher

- Delivery is medium

- Track your money

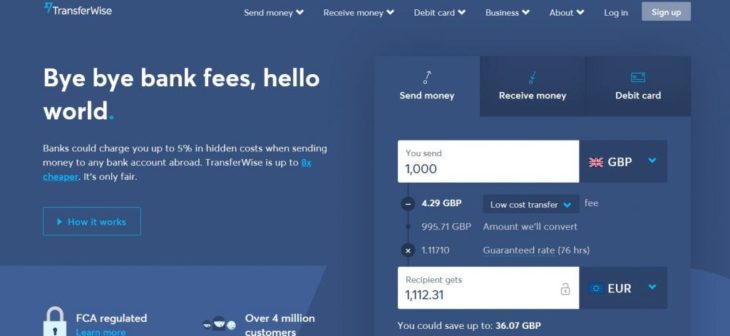

4. TransferWise

TransferWise is one of the fast money transfer options. Exchange rates are a bit higher while comparing to others. Many people have invested their money in TransferWise as it is much secured.

Source: TransferWise

WHY TO CHOOSE TRANSFERWISE?

- Fast Delivery

- Safe banking

- Customer support is good

WHY NOT TO CHOOSE TRANSFERWISE?

- Exchange rates are bit high

- For creating an account, you need to go through many procedures to reach the final step. They will ask for all the details for the identification process

5. Remitly

Remitly helps to transfer money across many banks in India. It takes much time to get delivered your money, for the express transferring it will take almost 5 hours and for economy transferring it would take up to 5 days. Remitly helps to tracks your money to see where it reached.

For new customers, they will ask additional charges. Exchange rates are higher; you need to pay extra money also. You need to create an account with all your identification cards and details; it would not be an easy task to fill up all the information.

Source: Remitly

WHY TO CHOOSE REMITLY?

- Good customer support

- Track your money

WHY NOT TO CHOOSE REMITLY?

- Slow delivery

- Exchange rates are bit high.

WHICH ONE IS THE BEST FOR YOU?

Each of these online money transferring services provides you with a safe transaction. You need to be very careful while choosing the right one for transferring the money.

In the case of the exchange rate, CrossLinks will give you the best exchange rate with no hidden charges. Tracking option is available in all of these options to track your money so that you don’t need to be worrisome. When it comes to customer support, Crosslinks and Remit2India are giving you a friendly supporting team to solve all your problems.

Crosslinks offer free first-time transaction with zero cost for new customers while others charge additional transaction charges for first-time users.