When you are in a need for a financial loan, you can always use some of the usual options for getting one. First, you can go to your bank to ask for it, or try to look for the credit from a private person. Both options are familiar to us, but they do not guarantee success. You can get rejected at the bank, or you can permanently break relationships with your friends because of money. So, is there a third possibility? What’s the best alternative? How can we get a loan in a whole new way?

You can find a solution. In the meantime, online platforms were developed with a purpose that private individuals can lend money to other private individuals at an agreed interest rate.

Contents

What Are P2P Credits?

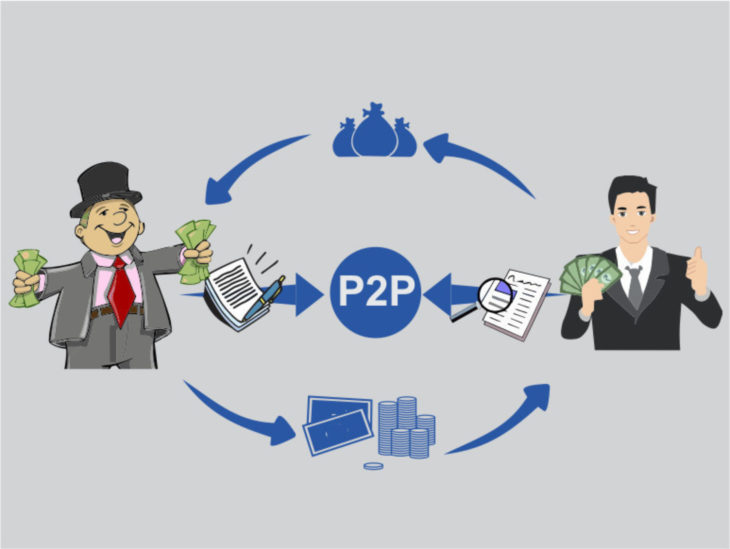

We’ll introduce you to P2P credit platforms, that is, platforms that offer such services. We’ll compare them and present you the experiences of people after a long period of investing. P2P stands for Peer-to-Peer. To put it more simple, P2P loans are those that one private person provides to another. Do you wonder why when we have banks available?! Here is an explanation.

The Difference Between The Bank And P2P Platforms

To get a better insight into the difference between these two services, let us first recall how a bank works. You save money in the bank and put it in your savings account. The bank gives you some percentage of interest to show you their gratitude. However, your bank does not keep your money in a safe deposit box. Instead, the bank passes it on to clients who need loans. It means you are indirect lenders.

Source: obviousinvestor

Principles Of Lending In Banks

The credit applicant goes to the bank and submits a written request for a certain amount of money. The bank checks the client’s credit rating and determines the interest at which the client will have to repay borrowed money. If the client’s rating is poor, the loan won’t be granted, or the interest will be extremely high. Banks are direct lenders. They put money directly in the hands of people who borrow money from them. The bank also determines the interest at which the money will need to be repaid. Of course, such interest is much higher than your bank would’ve given you as a reward for opening a saving account. Don’t forget that banks live and operate further due to the interest rates difference. Still, you must remember this – the bank is the one that carries all the credit risk.

How Does Lending Platforms Work?

These platforms operate quite similar to banks. They also have creditors and borrowers. However, unlike investing in a bank, a creditor is consciously investing money and deciding to whom he will give the credit. In this situation, an investor who lends the money is a direct credit provider who is taking the risk. Think of this platform as a place where the creditors and borrowers meet, and where people may borrow some money with interest. These platforms provide their services, so the two of them can meet. It also checks the credibility of the person who’s asking for a loan. For providing such services, these platforms get a certain commission – the same way as banks do. But, it is more comfortable, because you don’t have to go anywhere, nor meet the recipient personally. You can finish everything online. But, if the credit-taker fails to repay his or hers – you bear the risk as a direct credit investor.

P2P financial platforms have modified the way people apply for money-loans. These platforms allow you to realize the financial loan without going through so many arduous processes of signing contracts and bulky administration. Moreover, you can finish the work while you’re online. This kind of working system removes the possibility of annoying or inappropriate personal meetings with credit-agents.

Source: badcredit

The Best Loan Service Platforms – Our Suggestions

1. Mintos

Mintos P2P platform has over 175,000 active investors around the world. If you visit Crowdreality, you will see that more than €3.5 billion in crediting have been successfully realized by using this platform. When you open and fund a personal account, you can choose from a huge database containing over 450.000 loans available. You can make your purchase directly from creditors, or other investors. This platform also has several filters that can help you recognize the best possible options for crediting. They can even use many helpful tools such as auto-invest which is also available. According to 2019. analyses for, Mintos review received a rating of 4.5 out of a maximum of 5 in the overall score, making it one of the most reliable and successful platforms of its kind.

2. Lending Club

This is one of the best platforms that usually gets high marks. LC is practically a synonym for P2P-crediting services, and there are many reasons for that. This website made over $ 22 billion in lending services since early 2007. As their users claim, the interest rates and terms they offer are much better than any bank would provide. You can apply directly on the website and stay completely anonymous. The investors usually purchase the “notes” for many loans and do not fund the entire credit amount at once. Therefore, many creditors will be involved in helping to collect fund for your loan.

Source: fundingsocieties

3. Prosper

This is also a very popular P2P loan service. Prosper has been launched in 2005. They made more than $ 4 billion in financial credits and credited over 250.000 borrowers. Prosper provides loans in major US states. The loans usually go up to 40,000 dollars. As for the users, they have 3 to 5 years to finish the repayment. All credit transactions made on this platform are stable and amortized. The credits are not secured. Therefore, you can use them for various purposes.

4. Funding Circle

This platform started to work in 2010. It is a great choice for anyone who’s looking for commercial credit. Funding Circle can offer up to 500,000 dollars for that purpose with a minimum credit amount of 25.000 dollars. This platform has secured its loans total for over 1 billion dollars. They are conducting business with over 10,000 companies worldwide. The money you lend can be used for expanding a business, buying materials or equipment, and increasing your marketing campaign. Since these are huge money loans, you’re required to give more documentation. These credits also involve 3 years of business income tax.

Source: thejakartapost

5. Upstart

This is a website that is primarily focused on students refinancing. Therefore, they emphasize education and work history of debtors. It is their main criteria. Therefore, Upstart entitles you for an “employment promise” within 6 months. Their lending sums start from 3.000 and go up to 35.000 dollars over 36 months and has no penalties in case of early repayment.