In this fast-moving tech era, there are a lot of ways to make money and earn big bucks. Starting from doing odd jobs to conducting affiliate marketing or email marketing, there are plenty of easy ways to go about making money.

But making money by investing in the stock or share market can be quite hard, especially since it presents more challenges. Investments are a fast way to make money, yes, but they come with certain risk factors.

If you don’t know what you’re doing, you might end up losing more than you bargained for. To identify a good strategy is important but you need to find the strategy that works best for you and your requirements.

When it comes to investing, starting small, trying out different methods, and analyzing your results will help. However, this requires extensive research that will take a lot of time. A viable alternative to all this work is subscribing to share market newsletters.

In this article, we’ll be discussing what stock market newsletters are, why you need them, and some of the best newsletters out there.

Contents

What are Stock Market Newsletters?

Source: benzinga

To invest in the stock market, you don’t need a lot of money or any sort of hacks. What you need is a good understanding of how each stock and the overall market trends work. This is where share market newsletters come in.

These subscription service newsletters make predictions based on in-depth analysis of the market trends and behavior and provide recommendations based on those predictions.

Since the share market can be volatile at times, it becomes difficult to figure out or predict the shift in prices. This leads to confusion while selecting the ideal newsletter. You can check out the StocksReviewed stock newsletter reviews for further professional help.

Why Do You Need Stock Market Newsletters?

Source: ft

Stock market newsletters have been around for decades, recommending stocks by predicting future share prices through market analysis. They are a great way to stay informed and feel confident about what you purchase.

A well-written newsletter can help you find suitable shares, predict future market trends, allocate better portfolios, implement safety measures, and improve overall risk management.

It can serve as an intermediary in-between you completely depending on a financial advisor and going at it completely alone. It can also help you gain an extra edge against the market by providing you key financial insights.

-

Time Constraint

One thing you realize, when investing in the share market, is that time is crucial. Even in slow-moving markets, you can turn your investments into quick gains by leveraging the right strategies given by the newsletters at the right time.

-

Leveraging & Hedging

It is not all about predicting the upcoming trend, rather, it is about leveraging & hedging your investments and paying close attention to indicators. These newsletters are very useful in these matters. They provide a solid foundation to base your purchases.

-

Cost Friendly

Many financial advisors and stockbrokers charge commissions for trades and extra fees to manage your money. Many of them also charge commissions to promote certain financial products that will eventually benefit only them. Their interest doesn’t always align with the interest of their customers.

However, as an alternative, a share market newsletter can help you out in many ways. Since it is cost-friendly, having subscribed to one will help you gain key insights and save money in the process.

-

Risk Management

Investing on your own can be very risky, especially if you are not a financial expert. Simply putting money in exchange-traded funds (ETFs) or index funds will not help you beat the market. You will just make the average returns and miss out on high-return investments.

Moreover, if you buy shares without a proper understanding of the market and in-depth market analysis, you can lose a significant amount of money. On the contrary, stock market newsletters can help you understand the market and provide better results.

Top Performing Stock Market Newsletters

Source: time

Investors are always looking for newer ideas that can help them pick the best that comes with the lowest risk. Stock market newsletters survey the market thoroughly and streamline their findings down to a few profitable shares or economic tips.

Since there are many such newsletters out there, it is quite normal to feel overwhelmed with the choices. The most effective way to choose the right newsletter is to figure out what works for you and what sort of investor you are.

You have to know if you want recommendations or market trading strategies or overall market and economic overview or just a newsletter that specializes in a specific sector.

Whether you want macroeconomic news or microeconomic news, newsletters are going to give you a thorough understanding either way. Here are some top-ranking newsletters:

1. The Oxford Communiqué

Source: libertythroughwealthdaily

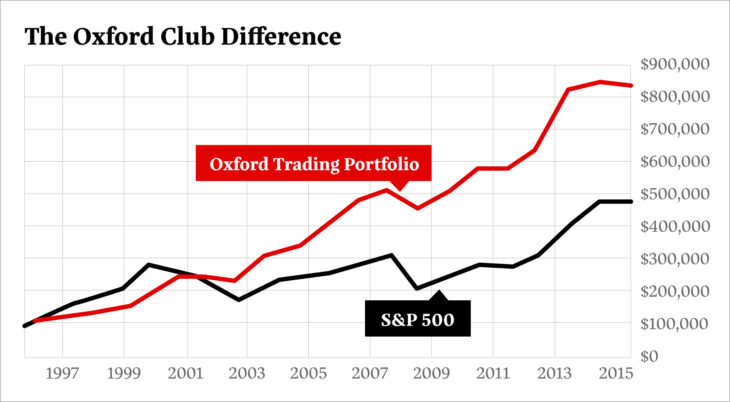

The Communiqué is The Oxford Club’s flagship newsletter that provides top-notch analysis and writing. It is a highly admired publication, edited by Alexander Green and Nicholas Vardy, that provides clear, practical advice for investors of every skill level.

It was ranked as one of the 10 top-performing newsletters in the US for the last 15 years by The Hulbert Financial Digest. With years of strategic investing experience and market knowledge, Alex and Nicholas help novice investors make big bucks.

2. Morning Brew

Source: techcrunch

This newsletter provides detailed insights on the latest trends and other significant market changes through daily email digest. Although it was initially designed for millennial entrepreneurs, these days almost everyone relies on it to stay informed about the share market.

Since Morning Brew has an in-depth understanding of stocks, it provides the readers with a sharp and compact analysis of the market.

3. Strategic Trends Investor

Source: squad

Written by The Oxford Club’s Chief Trends Strategist Matthew Carr, and Energy & Infrastructure Strategist David Fessler, Strategic Trends Investor uncovers the mysterious patterns and groundbreaking trends of Wall Street.

This newsletter covers emerging and longstanding trends and identifies high return investments across various sectors. Its editors, Matthew and Dave, seek out cutting-edge, disruptive trends to determine the best investment opportunities.

4. The Motley Fool

Source: wallstreetsurvivor

The Motley Fool analyzes the market and provides top picks using two different newsletters – Stock Advisor and Rule Breakers.

5. Stock Advisor

Source: washingtonpost

Founded by the Gardner brothers l, it provides expert stock recommendations and the investment thesis behind selecting them. It recommends potential high-flying shares with sound company fundamentals. It is published every month and costs $99 a year.

In addition to ten new suggestions, Tom and David Gardner each provide two monthly top recommendations. Since they focus on finding stocks that can outperform the market, they provide a healthy mix of growth and value investing.

Their top picks boast a 359% return on investment since they started 17 years ago. Some of those top picks include a return of over 11,000% on Amazon, 13,000% on Netflix, and 8,000% on Booking Holdings.

6. Rule Breakers

Source: marketwatch

This newsletter, founded by the Gardner brothers, is mostly created for aggressive investors. It provides detailed recommendations focusing on companies that have higher growth rates. Most of these companies are foreign-based.

It analyzes shares based on a few factors, such as – emerging industry, past price appreciation, consumer appeal, sustainable advantage, gross overvalue, and company management. Although it has slightly outperformed the Stock Advisor in recent years, its picks are still very volatile.

7. Bloomberg

Source: marketplacepioneers

This newsletter service is considered to be one of the top providers of information in the business world. It offers a wide range of news, starting from the global economy, companies, and industries, to technology, finance, and share markets. Their content provides in-depth market research and hindsight of different investment prospects.

8. Morningstar

Source: morningstar

Morningstar is very useful regarding personal financial planning. This newsletter focuses on mutual fund rating systems and stock analysis. It also covers ETFs and bonds. It performs in-depth research on company fundamentals and provides crafty investment strategies. It charges $29.95 monthly subscription fees.

9. The Oxford Income Letter

Source: bloggershq

Written by The Oxford Club’s Chief Income Strategist, Marc Lichtenfeld, The Oxford Income Letter is published every month by The Oxford Club. This financial newsletter focuses on different income strategies, including dividend-paying shares.

Since it has four portfolios with risks of different proportions, The Oxford Income Letter has the potential to generate high-yielding income. Marc taps into the wealth-generating power of income investments using his 10-11-12 system.

10. Linde Equity Report

Source: lindeequity

This newsletter service focuses on recommending quality rather than quantity. Since they provide a single recommendation each month, they are extremely selective of it.

They provide monthly updates on the stock that has been featured in the newsletter to every member, once they invest in it. They charge $149 a year as subscription fees.

Linde Equity Report was ranked as the number one newsletter in the US, from 2005-2015, by the Hulbert Financial Digest. Since the shares they recommend are often aggressive, this newsletter is better suited for investors who have a high tolerance for volatility.

11. Stansberry Research

Source: thecoinrise

This firm provides actionable investment recommendations and research to better guide its members to self-manage their portfolios. It generates the safest, most profitable investment ideas available. It charges a standard fee of $199 for each newsletter.

It has three entry-level newsletters – Stansberry’s Investment Advisory, True Wealth, and Retirement Millionaire. Although all three newsletters focus on sound companies, the last one is the most effective.

The newsletters are very detailed and structured. They recommend new stocks to their members every month. Additionally, they provide a thorough 5 to 6-page analysis of why it was selected.

12. Kiplinger’s Personal Finance

Source: statesville

This monthly share market newsletter focuses on money management and investing needs of young investors. It mostly covers long-term finance, homeownership, vehicle purchasing, and retirement savings. It charges $34.95 a year as subscription fees.

It provides comprehensive and low-cost investing opportunities by analyzing the latest financial and market trends, mutual funds and ETFs, bond investing, real estate, individual share, and retirement planning.

Conclusion

Investing in the stock market has a lot of moving parts. It is a lot more than just earning a little extra cash. If you don’t know what you are doing, you might lose big time.

However, with the right newsletters and comprehensive approach, anyone can make money off of shares and be on their way to earning millions. So, don’t hold back, select your ideal newsletter services, and start investing.