These days, self-employment, which means you are independent, is one of the finest ideas, there would be no external pressure on you to how you should run your business, and there will be no extra weight of work. You will work with your own norms and standards, and you will be the person in full charge and control of your business, this is called freelancing. The rate of people becoming self-employed is increasing day by day, and that’s where the QuickBooks comes in. For people who are doing business themselves, this application proves to be a valuable companion.

It is well-matched for self-employed such as Independent contractors, freelancers, solopreneurs, some social bloggers, property or real estate managers.

QuickBooks Self-Employed is great accounting software for small and medium-sized businesses run by self-employed people. It will automatically track mileage, will sperate personal and business expense will maximize your deductions of Schedule C. Also, it calculates quarterly estimated taxes automatically. There is a TurboTax bundle offered by QuickBooks Self-employed. It pays taxes online which is estimated quarterly. TurboTax Self-Employed can export Schedule C and makes filing faster. It also tracks and sends simple invoices.

Let’s see how it is beneficial for any freelancer or self-employed user:

Contents

- Planning of Tax and Tax saving

- Alerts for due dates for Tax payments

- TurboTax Bundle

- Automatic tracking of Mileage:

- Credit card and Bank accounts can be connected

- Up-to-date Dashboard

- Consulting for your business:

- Planning of Retirement:

- Attachment of a Receipt

- Financial Reports

- Separation of corporate and personal expenses from each other

- Cloud-Based

- Collects Data

- Invoices on the go

- Smartphone Feature

Planning of Tax and Tax saving

Source: YouTube

According to QB Techs, most of the self-employed or freelancers may face some problems regarding tax planning. As most of them don’t have extra time or understanding of tax planning for year-end files or payments details. There is a chance that freelancer may not know how to put together their records for tax purpose.

QuickBooks Self-Employed Tax feature will help users in managing and planning of their tax according to requirements. It will help them with how they can plan and save tax, before tax due dates and help users to avoid late fine without any headache.

Alerts for due dates for Tax payments

You can set tax due dates reminders and QuickBooks Self Employed will provide recommendations for estimate payments of tax by projecting your yearly profit.

TurboTax Bundle

Tax bundle offered by QuickBooks Self-Employed helps in automatically calculation of estimated quarterly taxes. It will help in maximizing deductions of Schedule C. you can pay online estimated quarterly taxes. TurboTax Self-Employed can export Schedule C and makes filing faster.

Automatic tracking of Mileage:

QuickBooks Self-Employed comes with an app of tracking mileage. So if you travel for your business, you can deduct the mileage cost or vehicle-related expenses. The app can be downloaded on your iPhone or Android device. This app will automatically track your start and your stop point for all of your journeys.

Credit card and Bank accounts can be connected

Source: Medium

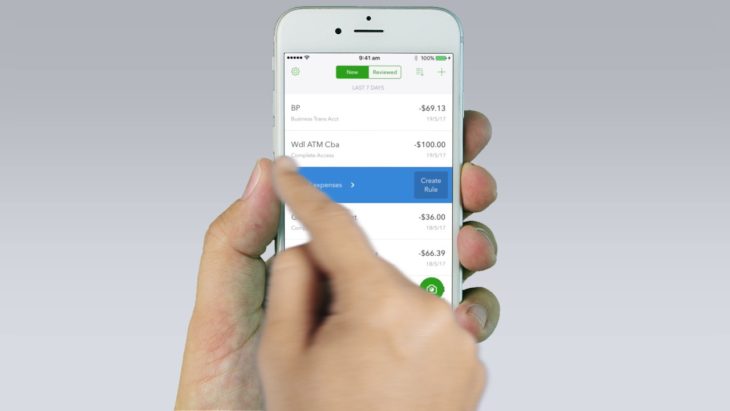

You can easily download your credit card and bank transactions straight into your account. This can be used to characterized to finish the Schedule C.

Up-to-date Dashboard

QuickBooks Self-Employment has a dashboard where most up to date information is available.

Where you can see the information about Balance of credit card and bank account, profit and loss.

Consulting for your business:

This software will help you with bookkeeping and managing your business. It will guide the user in seeing and making decisions for a company to be successful.

Planning of Retirement:

QuickBooks will help the user in planning and tax benefits they will obtain from retirement plans. Most self-employed individuals are unaware of it, and this feature will be beneficial for them and will help users to make retirement plans. Creating awareness in users about getting the tax benefits of creating early retirements plans. It is always advised to be prepared early for everything so later you can enjoy the benefits without any headaches or extra stress.

Attachment of a Receipt

Source: Mobile Transaction

You can now take a photo of a receipt and then attach directly to the transactions from your mobile device since this app is available for both Android and IOS devices.

Financial Reports

Tax detail and summary, statement of Profit and loss can be effortlessly downloaded and you can then email them to your accountant for filing of tax.

Separation of corporate and personal expenses from each other

When setting up a bank account, you can also set up a personal expense category as well. For Tax purposes, you have to separate business from your personal expenses so that any spending that is personal can be excluded from the tax deduction. For example, if you don’t work from your home, but your rent cheque has been downloaded from the bank. This expense is personal, so it should be characterized as one.

It is never a good idea to mix together your personal account with a business account if you don’t have one, then you need to make it. It is also very important during the audit.

Cloud-Based

QuickBooks is a cloud-based software so it is really easy to manage.

Collects Data

Source: Datafloq

Just like the online version, QuickBooks Self-employed also collects data. For future reference, the most important term is the collection of data.

Invoices on the go

You can easily know the instant your invoice is sent, seen and paid. You can invoice your clients easily through your mobile device. By allowing online payment options you can get paid faster.

Smartphone Feature

These days most work can be done easily through mobile devices. So, using the app in mobile devices is very convenient and accessible everywhere. In some countries, the small-sized business has internet access by means of mobile phones and prefer to work from their mobile devices.

If you are interested in QuickBooks Self-employed software, and you want to try it out for yourself to see how it suits your business, and you are tired of using Excel spreadsheet for organizing your expenses and profits, you can simply get their free trial for 30 days where you can use full features for free, and you don’t have to pay anything right away.